On completion of first year of business Imelda Folly has prepared her Statement of income for the

Question:

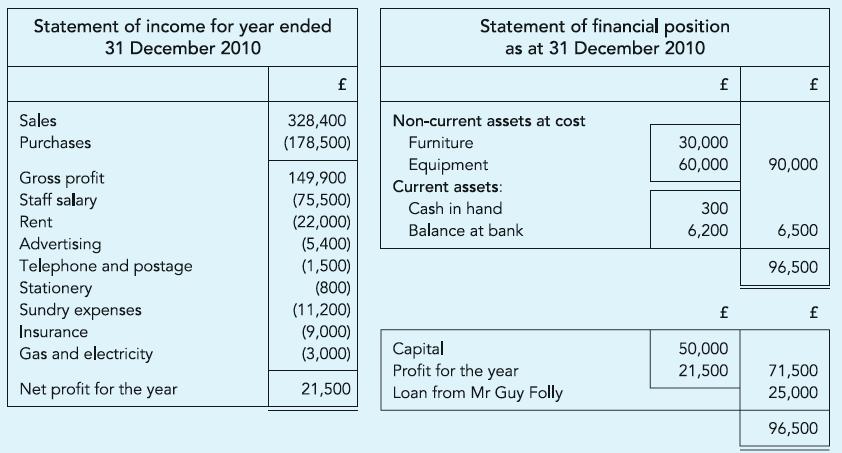

On completion of first year of business Imelda Folly has prepared her Statement of income for the year ended 31 December 2010 and her Statement of financial position as at that date as shown below:

At her request you reviewed the financial statements and have identified the following:

(a) £105,000 due from customers for sales made in the year has not been accounted for on the premise that these amounts were not received until 2011.

(b) Goods costing £45,000 remained unsold at year-end but have not been accounted for.

(c) Expenses remaining unpaid at year-end, but not accounted for, were salary £25,800, advertising £4,500 and one month’s rent agreed at £2,000 per month. The loan owed to Guy, Imelda’s husband, however, is interest free and repayable only when able.

(d) Insurance, paid on 1 April 2010, was for one year from that date.

(e) Included within sundry expenses are £2,800 paid as membership fees for Imelda’s Ladies Club and £1,400 paid as school fees for her son.

(f) Other than an equipment acquired on 1 July 2010 for £15,000, all furniture and equipments were acquired at commencement of business and are to be depreciated at 10% and 20% per annum, using the straight-line method.

Required:

Re-draft the financial statements of Imelda’s business in compliance with the accruals concept.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict