A and B are partners in a firm sharing profits and losses in 7:3. The balance sheet

Question:

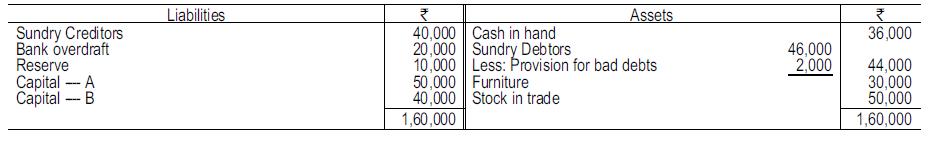

A and B are partners in a firm sharing profits and losses in 7:3. The balance sheet as at 31.3.2018 is as follows: On 1.4.2018 C joins the firm as a 3rd partner for 1/4th share of the future profits of the firm on the following terms:

On 1.4.2018 C joins the firm as a 3rd partner for 1/4th share of the future profits of the firm on the following terms:

(a) Goodwill is valued at ₹40,000 and C is to bring the necessary amount in cash as premium for goodwill.

(b) 20% of the reserve is to remain as a provision against bad and doubtful debts.

(c) Stock-in-trade is to be reduced by 40% and furniture is to be reduced to 40%.

(d) A is to pay off the Bank overdraft.

(e) C is to introduce ₹30,000 as his share of capital to which amount other partners’ capital shall have to be adjusted. You are required to show the necessary journal entries to carry out the above transactions and prepare an amended Balance Sheet of the firm immediately after C has become a partner.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee