Blue Moon Taxi Service is a very busy local taxi service. Recently, a retirement village opened up

Question:

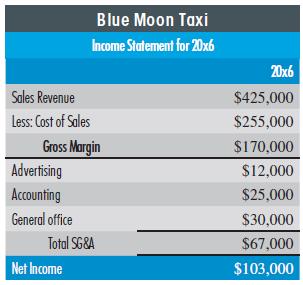

Blue Moon Taxi Service is a very busy local taxi service. Recently, a retirement village opened up in Blue Moon’s area, driving up volumes to the point where Blue Moon is having trouble responding in a timely manner to requests for rides. The owner of Blue Moon, Charlie Owens, has to decide on a plan going forward; he has several opt ions available to him. The results for last year are shown in the table below. Blue Moon is weighing the following options:

Blue Moon is weighing the following options:

• Scenario 1: Buy three new tax is at a cost of $120,000. They would be amortized over a four-year period and paid for in installments over that period of time. Each new taxi would increase sales revenue by 10%, for a total increase of 30%. Cost of sales, which is the drivers’ cost and fuel, would remain steady at the 20x6 rate. Charlie feels he would need to do some initial advertising to get the sales revenue he needs to generate for the three new tax is. He estimates this would cost an additional $8,000 for the year. Accounting costs would increase 10%, while general office costs would remain unchanged.

• Scenario 2: Lease three new tax is at a cost of $50,000 per year. Again, each new taxi would increase sales revenue by 10%. Cost of sales would go up 3%, however, as the leased tax is require a higher insurance premium. Advertising would again go up $8,000 for the year. Accounting would again increase 10%, while general office costs would go up 5% because of the additional paperwork the leasing company requires. The leases would run annually, which means Charlie could drop the three additional tax is if they are not being used with minimal penalty.

• Scenario 3: Do nothing. Charlie could expect to increase his revenues 5% more before he had to start turning down business. Cost of sales would remain steady at 60%. All other costs would remain at their 20x6 level.

REQUIRED:

a. Develop income statements for the three scenarios.

b. What would you recommend that Charlie do? Why?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant