PepsiCo, Inc. reports ($ 26,445) million of long-term debt outstanding as of December 2012 in the following

Question:

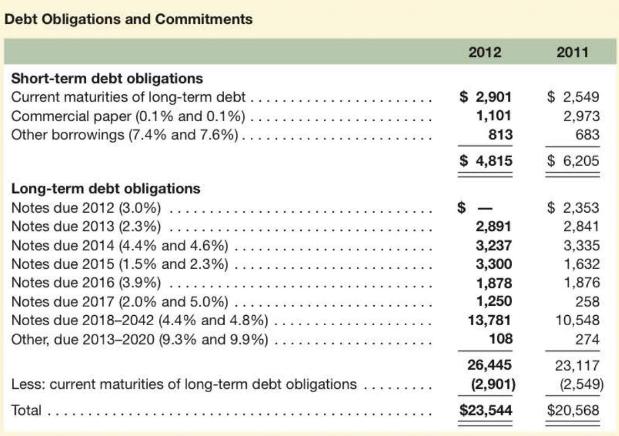

PepsiCo, Inc. reports \(\$ 26,445\) million of long-term debt outstanding as of December 2012 in the following schedule to its \(10-\mathrm{K}\) report.

Required

a. PepsiCo reports current maturities of long-term debt of \(\$ 2,901\) million as part of short-term debt. Why is this amount reported that way? PepsiCo reports \(\$ 6,450\) million of long-term debt due in 2014-2015. What does this mean? Is this amount important to our analysis of PepsiCo? Explain.

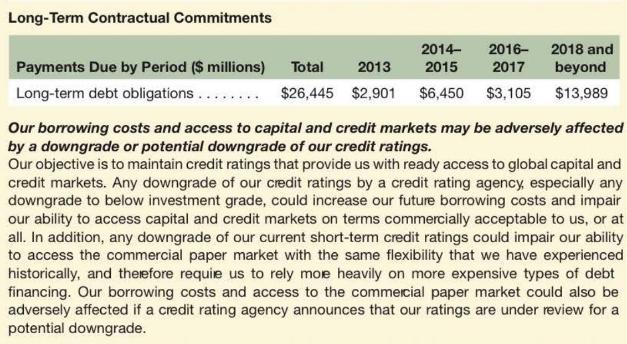

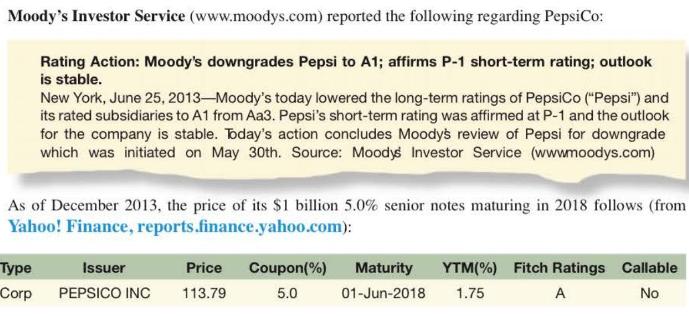

b. The \(\$ 1\) billion \(5.0 \%\) notes maturing in 2018 are priced at \(113.79(113.79 \%\) of face value, or \(\$ 1.1379\) billion) as of December 2013, resulting in a yield to maturity of \(1.75 \%\). Assuming that the credit rating of PepsiCo has not changed, what does the pricing of this bond imply about interest rate changes since PepsiCo issued the bond?

c. What does the schedule of long-term contractual commitments reveal that might be useful in analyzing PepsiCo's liquidity?

d. Moody's Investors Service lowered the long-term ratings of PepsiCo in 2013. Why might a reduction in credit ratings result in higher interest costs and restrict PepsiCo's access to credit markets?

\(e\). What type of actions can PepsiCo take to improve its credit ratings?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton