Question: Consider a binomial model with three dates as introduced at the end of Sect. 6.3 (with (t in{0,1,2}) ) and a contingent claim with payoff

Consider a binomial model with three dates as introduced at the end of Sect. 6.3 (with \(t \in\{0,1,2\}\) ) and a contingent claim with payoff \(f\left(s_{2}\right)\), where \(s_{2}\) denotes the price of the risky asset at the terminal date \(T=2\). By using a backward induction procedure, compute the arbitrage free price of the claim as well as the associated hedging strategy. Verify that the arbitrage free price computed at the initial date \(t=0\) coincides with the discounted risk neutral expectation (see Corollary 6.34).

By using a backward induction procedure, compute the arbitrage free price of the claim as well as the associated hedging strategy. Verify that the arbitrage free price computed at the initial date \(t=0\) coincides with the discounted risk neutral expectation (see Corollary 6.34).

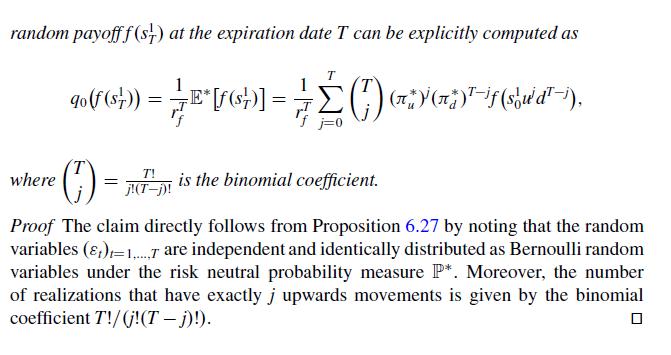

Data From Corollary 6.34

![holds that 90(X) = Q(X) = 1 E* [XT]. Proof Since the](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1712/2/7/2/916660f361478c591712272913630.jpg)

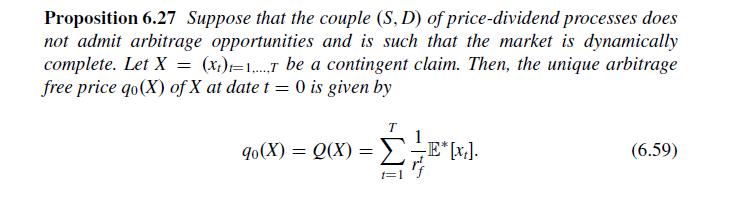

Data From Proposition 6.27

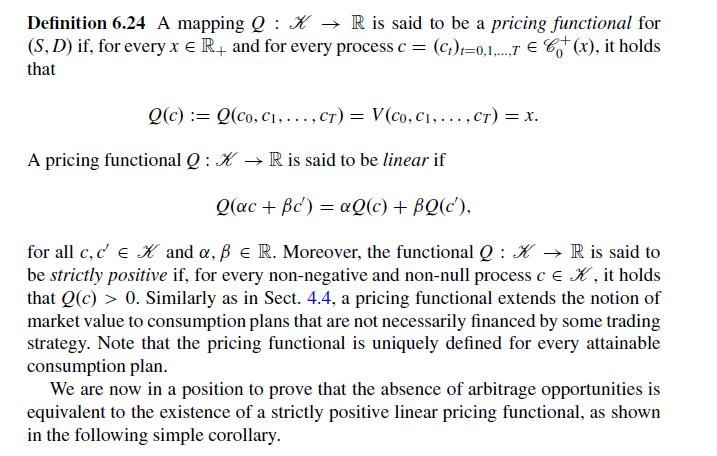

Data From Definition 6.24

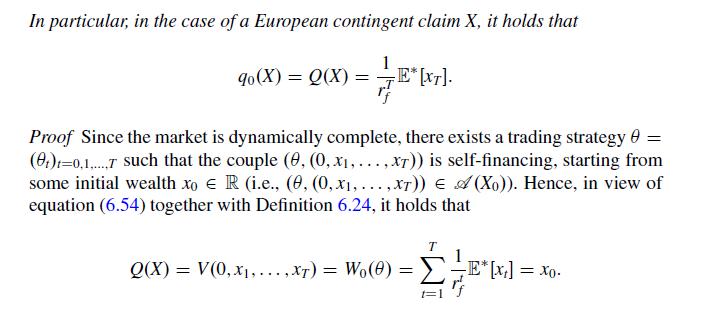

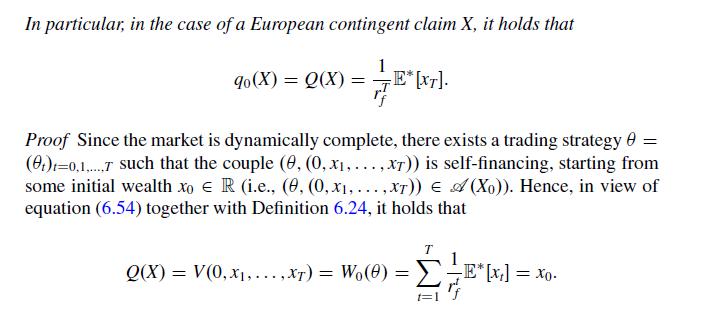

In particular, in the case of a European contingent claim X, it holds that 90(X) = Q(X) = 1 E* [XT]. Proof Since the market is dynamically complete, there exists a trading strategy 0 = (t)=0.1 such that the couple (0, (0,x1,...,xT)) is self-financing, starting from some initial wealth xo E R (i.e., (0, (0,x1,...,xT)) = (Xo)). Hence, in view of equation (6.54) together with Definition 6.24, it holds that T Q(x) = V(0,x1,...,x) = Wo(0) = =E* [x] = xo-

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts