Question: Consider two bonds maturing in five years. The first one has coupon rate (9 %) (assume a single annual coupon) and its price is 104.36

Consider two bonds maturing in five years. The first one has coupon rate \(9 \%\) (assume a single annual coupon) and its price is 104.36 (face value is 100 ). The second one has coupon rate \(7 \%\) (annual coupon, again) and its price is 96.3 . What is the price of a zero-coupon bond maturing in five years?

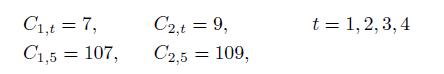

It seems that we have very little information, but we may easily find the only price of the zero that is in line with the other two bond prices. We have just to realize that the two coupon-bearing bonds have synchronized cash flows:

whereas the zero has only one cash flow at maturity, \(C_{z 5}=100\).

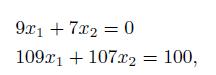

We may easily build a portfolio consisting of the two couponbearing bonds, replicating the cash flow of the zero, by solving the following set of linear equations:

where \(x_{1}\) and \(x_{2}\) are the amount of the two bonds in the replicating portfolio. Solving the system yields

\[x_{1}=\frac{7}{2} \quad x_{2}=\frac{9}{2}\]

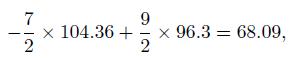

Note that the first position takes a negative value, i.e., we should sell the first bond short. The value of the replicating portfolio is

which must be the price of the zero, if we rule out arbitrage opportunities. Note that we are implicitly assuming that default risk is negligible for all of the bonds involved, that short-selling is possible, and the market is frictionless.

C1,t=7, C1,5 = 107, C2,t = 9, t = 1,2,3,4 C2,5 = 109,

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Given Information We have two bonds maturing in 5 years Bond 1 Coupon rate 9 Annual coupon 9 since f... View full answer

Get step-by-step solutions from verified subject matter experts