Let us check if and by how much using convexity improves the approximation of the bond price

Question:

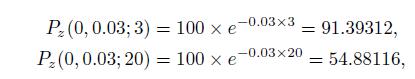

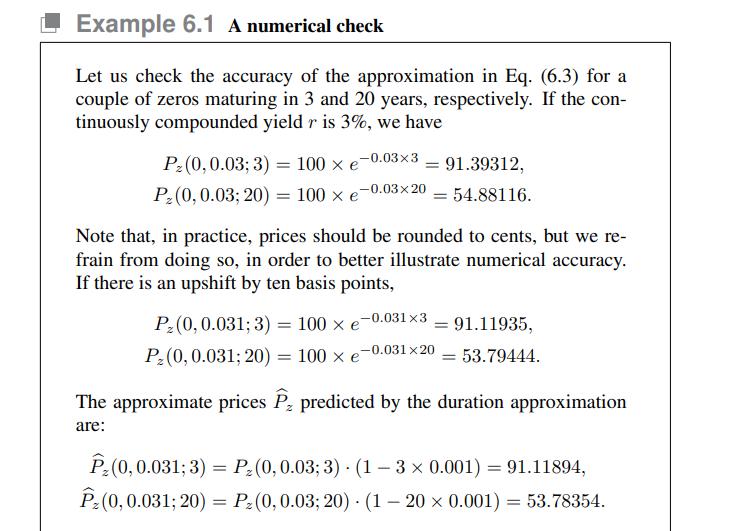

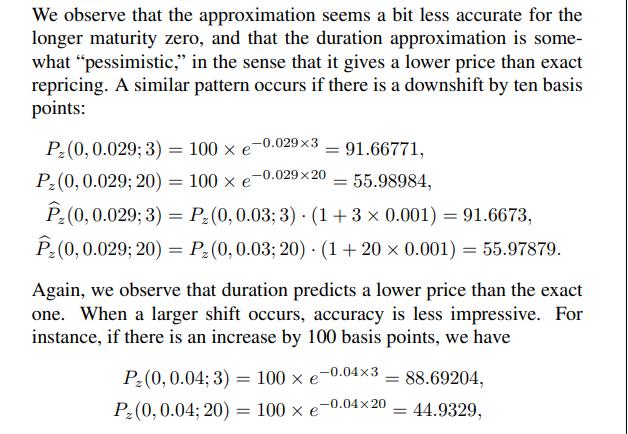

Let us check if and by how much using convexity improves the approximation of the bond price changes that we have considered in Example 6.1. As we have seen there, the prices of two zeros maturing in 3 and 20 years, respectively, are

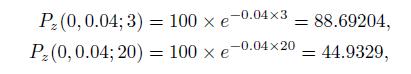

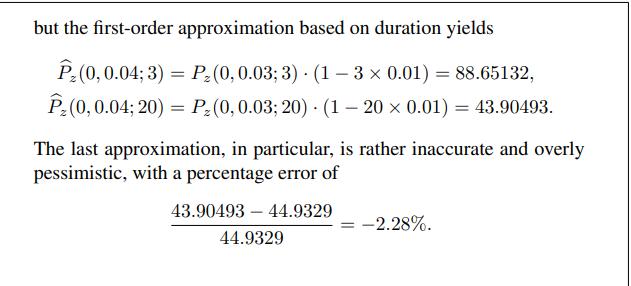

When yield is 3%, and they drop to

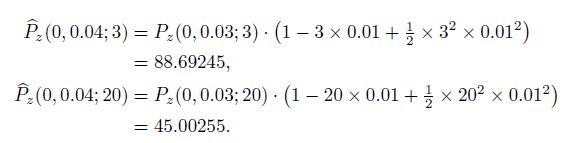

when there is an increase by 100 basis points. If we use both duration and convexity, we find the approximations

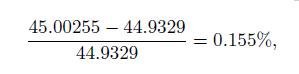

These approximations are definitely more accurate than those provided by a first-order expansion. For the second zero, the percentage error drops (in absolute value) from \(228 \%\) in Example 6.1 to

when adding the second-order term.

Data From Example 6.1

Data From Equation (6.3)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: