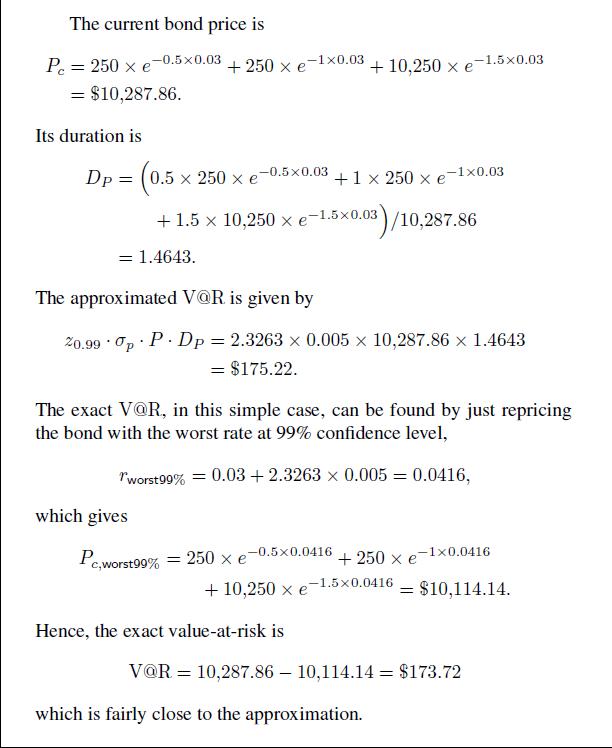

Let us consider again the coupon-bearing bond of Example 6.2. If the term structure is flat and

Question:

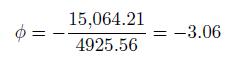

Let us consider again the coupon-bearing bond of Example 6.2. If the term structure is flat and the continuously compounded rate is \(3 \%\), we have seen that the bond price and durations are \(P_{c}(0 ; 0.03)=\) \(\$ 10287.86\) and \(D_{P}=1.4643\), respectively. Thus, the dollar duration of this bond is

![]()

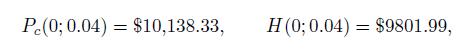

Suppose that we hedge interest rate risk with a short position in a zero maturing in six months, with a face value of \(\$ 10,000\), like the coupon-bearing bond. The price of this hedging instrument is

![]()

Its duration is 0.5, and its dollar duration is

![]()

Hence, the short position should consist of

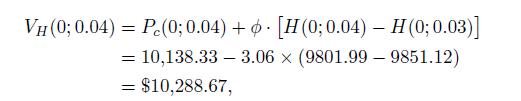

units of the zero. We neglect rounding issues, and we assume that the short sale is feasible, possibly through the repo market. No initial cash outlay is needed (we ignore haircuts, margins, etc.). Hence, the current value of the hedged portfolio is just the bond price:

![]()

Let us assume that there is a parallel up shift by 100 basis point, i.e., the new term structure is flat at \(4 \%\). This is assumed to be instantaneous and takes place at time \(t=0\). The new bond prices are easily computed,

and the value of the hedged portfolio changes to

which is very close to the initial one, with some difference due to convexity effect. The loss on the coupon-bearing bond is compensated by the profit from the short position on the zero.

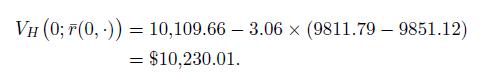

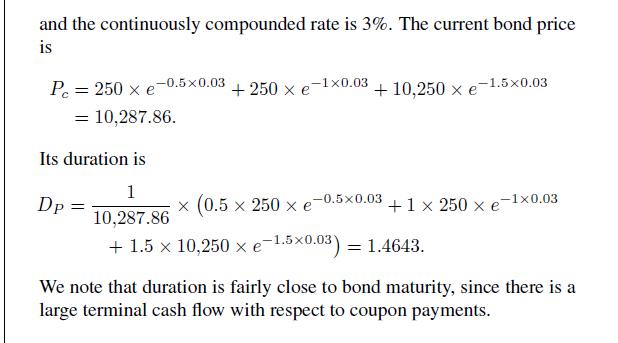

However, what if the shift is nonparallel? Let us assume that the new term structure is not flat anymore:

![]()

Note that, on the average, the new interest rate is \(4 \%\), as with the parallel shift. The new bond prices are

![]()

and the value of the hedged portfolio is only

In this case, the drop in the price of the zero is not enough to compensate the loss on the bond and we end up being under-hedged. The overall loss ( \(-0.56 \%\) ) does not look quite impressive, but this happens because the maturity of the coupon-bearing bond is rather short (see Problem 6.5). Probably, we would be better off with a zero with a longer maturity, but the general point is that, since we are dealing with three risk factors, we must introduce additional hedging instruments and assess individual sensitivities for each risk factor.

Data From Problem 6.5

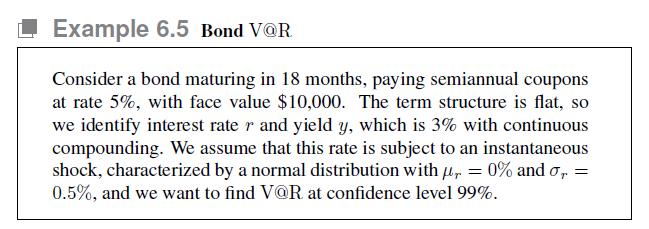

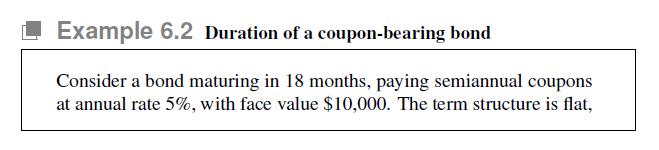

Data From Example 6.2

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte