Suppose that asset returns are uncorrelated, so that is a diagonal matrix, with entries . Then, the

Question:

Suppose that asset returns are uncorrelated, so that  is a diagonal matrix, with entries

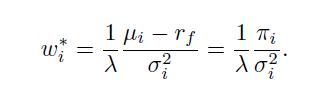

is a diagonal matrix, with entries  . Then, the weight for each risky asset \(i\) in the optimal portfolio, which also includes the risk-free asset, is

. Then, the weight for each risky asset \(i\) in the optimal portfolio, which also includes the risk-free asset, is

In this simplified case, portfolio weights depend in an obvious way on the risk aversion coefficient  , the risk premium

, the risk premium , and risk

, and risk  . We also observe that this solution is formally identical to the case of simple capital allocation; see Eq. (8.5).

. We also observe that this solution is formally identical to the case of simple capital allocation; see Eq. (8.5).

Data From Equation (8.5)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: