Question: In the example below, use Excel to find an envelope portfolio whose with respect to the efficient portfolio y is zero. Notice that because

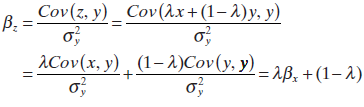

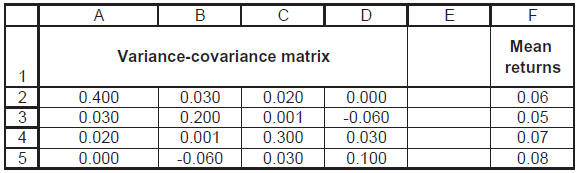

In the example below, use Excel to find an envelope portfolio whose β with respect to the efficient portfolio y is zero. Notice that because the covariance is linear, so is β: Suppose that z = λx + (1 - λ) y is a convex combination of x and y, and that we are trying to find the βz. Then

Cov (z. y) _Cov (+ (1-2), ) B = COV(x, ) . (1-1)Cov(y. y) , + (1-2). = 1B, + (1 2) A B D Mean returns Variance-covariance matrix 0.06 0.020 0.001 0.400 0.030 0.000 3 0.030 0.200 -0.060 0.05 0.07 4 0.020 0.001 0.300 0.030 0.100 0.000 -0.060 0.030 0.08

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

The question is about finding a portfolio z that combines two other portfolios x and y where the beta of portfolio z with respect to portfolio y is ze... View full answer

Get step-by-step solutions from verified subject matter experts