Question: Using the data from the previous example, simulate 36 months of stock returns assuming the same variance-covariance structure as the historical returns. Notice that it

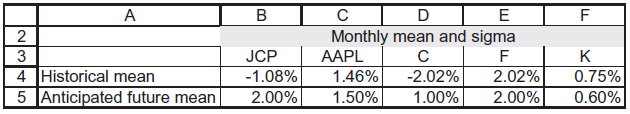

Using the data from the previous example, simulate 36 months of stock returns assuming the same variance-covariance structure as the historical returns. Notice that it doesn?t make sense to assume that the forward-looking expected monthly returns are the same as the historical returns. Instead, use the following values:

TC D E Monthly mean and sigma B F 2 3 JCP APL F K 4 Historical mean -1.08% 1.46% -2.02% 2.02% 0.75% 5 Anticipated future mean 2.00% 1.50% 1.00% 2.00% 0.60%

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

To simulate 36 months of stock returns using the given variancecovariance structure and forwardlooki... View full answer

Get step-by-step solutions from verified subject matter experts