Which profitability metric should French use to assess Archways five-year historic performance relative to its competitors? A.

Question:

Which profitability metric should French use to assess Archway’s five-year historic performance relative to its competitors?

A. Current ratio B. Operating margin C. Return on invested capital Nigel French, an analyst at Taurus Investment Management, is analyzing Archway Technologies, a manufacturer of luxury electronic auto equipment, at the request of his supervisor, Lukas Wright. French is asked to evaluate Archway’s profitability over the past five years relative to its two main competitors, which are located in different countries with significantly different tax structures.

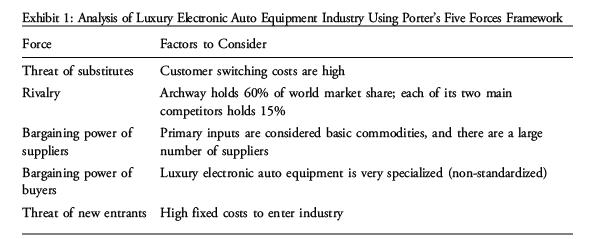

French begins by assessing Archway’s competitive position within the luxury electronic auto equipment industry using Porter’s five forces framework. A summary of French’s industry analysis is presented in Exhibit 1.

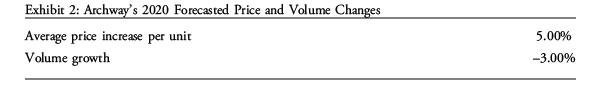

French notes that for the year just ended (2019), Archway’s COGS was 30% of sales. To forecast Archway’s income statement for 2020, French assumes that all companies in the industry will experience an inflation rate of 8% on the COGS. Exhibit 2 shows French’s forecasts relating to Archway’s price and volume changes.

After putting together income statement projections for Archway, French forecasts Archway’s balance sheet items. He uses Archway’s historical efficiency ratios to forecast the company’s working capital accounts.

Based on his financial forecast for Archway, French estimates a terminal value using a valuation multiple based on the company’s average price-to-earnings multiple (P/E) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company’s future prospects. Wright asks French:

“What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizon?”

Step by Step Answer:

Corporate Finance Workbook Economic Foundations And Financial Modeling

ISBN: 9781119743811

3rd Edition

Authors: CFA Institute, Michelle R. Clayman, Martin S. Fridson, George H. Troughton