Mickelson reports on a calendar-year basis. On January 1, 20X1, Mickelson Corporation enters into a three-year lease

Question:

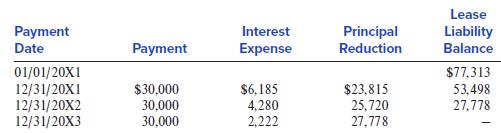

Mickelson reports on a calendar-year basis. On January 1, 20X1, Mickelson Corporation enters into a three-year lease with annual payments of $30,000. The first payment will be due on December 31, 20X1. The present value of the payments at 8% is $77,313. If the lease is classified as a finance lease, the following amortization table would be used to record interest expense:

Required:

1. Assume the lease is classified as a short-term lease. Show for each year the effects on the operating, investing, and financing activities sections of the statement of cash flows (direct method).

2. Assume the lease is classified as a finance lease. Show for each year the effects on the operating, investing, and financing activities sections of the statement of cash flows (direct method). Assume that the leased asset is amortized over three years.

3. Assume the lease is classified as an operating lease. Show for each year the effects on the operating, investing, and financing activities sections of the statement of cash flows (direct method).

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer