Question: Sonic Solutions develops digital media products, services, and technologies for consumers and content development professionals. In June 2010, a team of analysts at J.P. Morgan

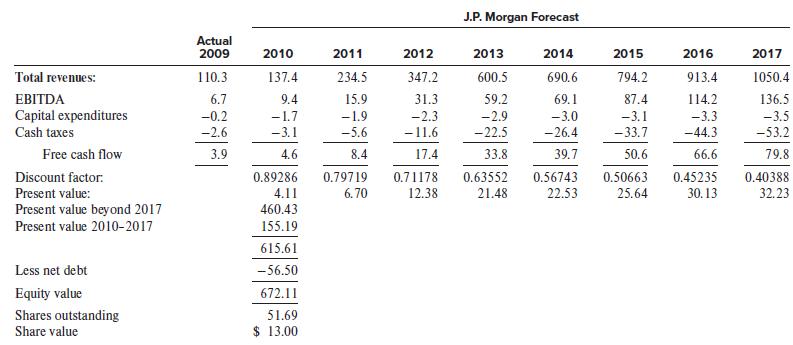

Sonic Solutions develops digital media products, services, and technologies for consumers and content development professionals. In June 2010, a team of analysts at J.P. Morgan issued a research report that valued Sonic’s stock at $13 per share, compared to the then-current market price of $8.71. The research report’s discounted cash flow valuation table is reproduced below (slightly edited for improved clarity). The 2009 figures are as reported by Sonic, but the 2010 through 2017 figures are J.P. Morgan analysts’ forecasts. Key assumptions include a weighted- average cost of capital (WACC) of 12% and a perpetual growth rate of 5%. All dollar amounts are in millions except share value.

Required:

1. Comment on how the free cash flow spreadsheet calculation compares with how accountants and auditors might compute free cash flow directly from the company’s financial statements.

2. Compute the annual rate of growth in forecasted sales and free cash flow for each year (2010 through 2017). Comment on the relative rates of sales and free cash flow growth.

3. What role does the 12% weighted average cost of capital assumption play in the discounted cash flow valuation analysis?

4. Write a brief paragraph explaining to someone unfamiliar with present value calculations how the figure $155.19 for Present value 2010–2017 is computed.

5. Explain how the figure $460.43 for Present value beyond 2017 is computed.

6. Why does the analyst team subtract an amount for net debt in arriving at Equity value? (Note: The term net debt is defined for spreadsheet purposes as financial liabilities (e.g., loans) minus any financial assets (e.g., money market investments) and is negative in the spreadsheet because Sonic’s financial assets exceed its financial liabilities.)

7. What share value estimate would the J.P. Morgan team have calculated if they had used an abnormal earnings value approach rather than a discounted cash flow approach and had developed forecasts of abnormal earnings and book values that were consistent with the cash flow forecast in the above worksheet? Why?

8. Sometimes analysts’ research reports contain inadvertent computational errors. What would the estimated value of Sonic’s stock have been if the J.P. Morgan team mistakenly used 34.60 million shares outstanding rather than the correct 51.69 million share count?

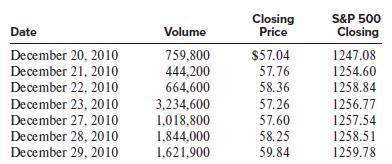

9. Rovi Corporation announced on December 22, 2010, that it had agreed to acquire Sonic Solutions for a combination of cash and stock worth $14 per Sonic share. Sonic shareholders could choose between receiving $14 cash for each Sonic share they owned and Rovi shares having a value of $14.

Here is a summary of the trading in Rovi’s stock in the days surrounding the announcement. What does this information suggest about how Rovi shareholders viewed the transaction?

J.P. Morgan Forecast Actual 2009 2010 2011 2012 2013 2014 2015 2016 2017 Total revenues: 110.3 137.4 234.5 347.2 600.5 690.6 794.2 913.4 1050.4 EBITDA 6.7 9.4 15.9 31.3 59.2 69.1 87.4 114.2 136.5 Capital expenditures -1.7 -2.3 -11.6 -0.2 -1.9 -2.9 -3.0 -3.1 -3.3 -3.5 Cash taxes -2.6 -3.1 -5.6 -22.5 -26.4 -33.7 -44.3 -53.2 Free cash flow 3.9 4.6 8.4 17.4 33.8 39.7 50.6 66.6 79.8 0.56743 22.53 0.45235 30. 13 Discount factor: 0.89286 0.79719 0.71178 0.63552 0.50663 25.64 0.40388 Present value: 4.11 6.70 12.38 21.48 32.23 Present value beyond 2017 460.43 Present value 2010-2017 155.19 615.61 Less net debt -56.50 Equity value 672.11 Shares outstanding Share value 51.69 $ 13.00

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Requirement 1 Free cash flow is defined in the spreadsheet as EBITDA minus capital expenditures and cash taxes where EBITDA refers to earnings before interest taxes depreciation and amortizationThis s... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

2065_60bca4344f260_848101.pdf

180 KBs PDF File

2065_60bca4344f260_848101.docx

120 KBs Word File