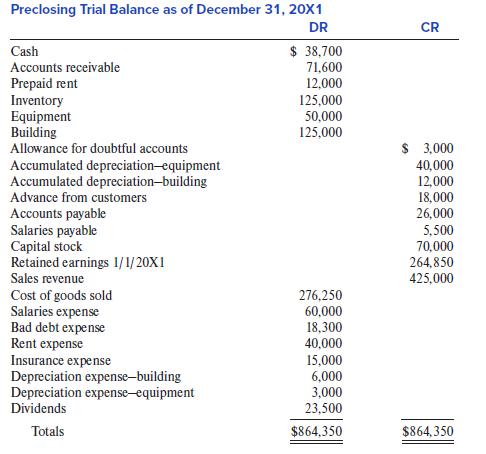

The following is the preclosing trial balance of Ralph Retailers, Inc.: The following additional information is provided:

Question:

The following is the preclosing trial balance of Ralph Retailers, Inc.:

The following additional information is provided:

a. The company paid a salary advance of $5,000 to one of its employees, a total that was debited to the Salaries expense account. This was an advance against the employee’s salary for the year 20X2.

b. On January 1, 20X1, the company paid an insurance premium of $15,000, which was debited to the Insurance expense account. The premium provided insurance coverage for 18 months beginning on January 1, 20X1.

c. The company decided to revise its estimate of bad debts expense by calculating it at 5% of its sales revenue.

d. On December 31, 20X1, the company’s board of directors declared a dividend of $20,000, payable in January 20X2. No journal entry was recorded.

Required:

1. Prepare the necessary adjusting entries for the year ended December 31, 20X1.

2. Prepare an income statement for the year ended December 31, 20X1. Ignore income taxes.

3. Prepare a balance sheet as of December 31, 20X1.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer