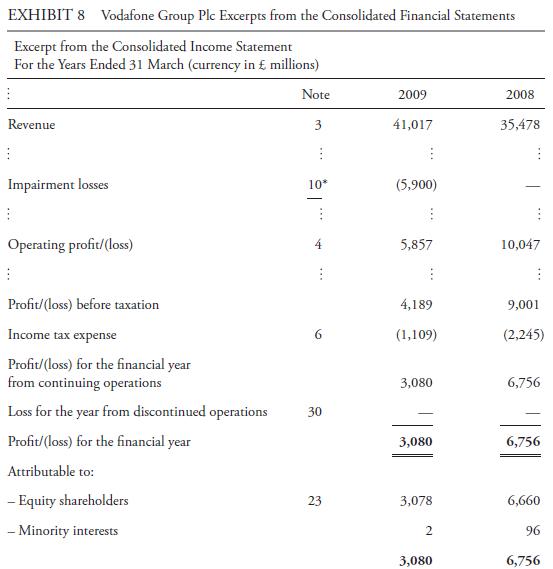

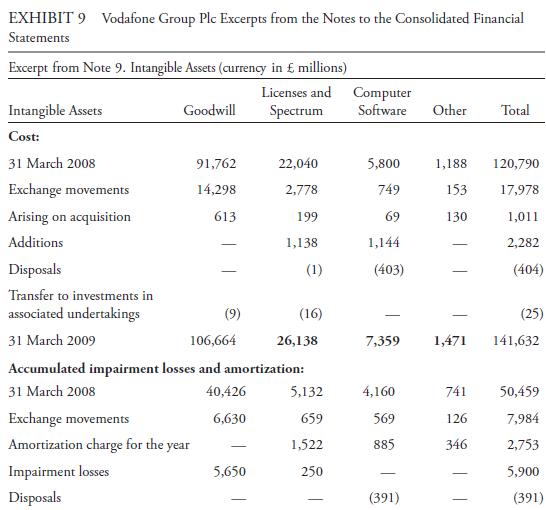

The following exhibits include excerpts from the annual report for the year ended 31 March 2009 of

Question:

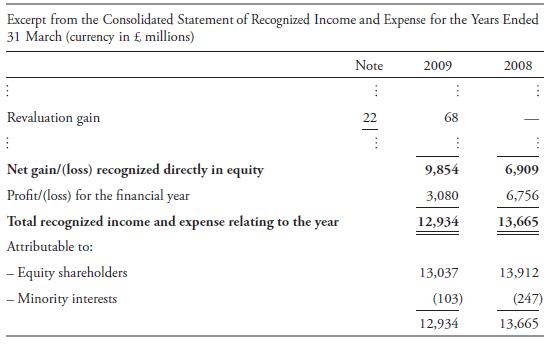

The following exhibits include excerpts from the annual report for the year ended 31 March 2009 of Vodafone Group Plc (London: VOD), a global mobile telecommunications company headquartered in the United Kingdom.

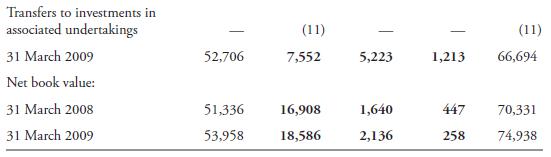

For licenses and spectrum and other intangible assets, amortization is included within the cost of sales line within the consolidated income statement. Licenses and spectrum with a net book value of £2,765m (2008: £nil) have been pledged as security against borrowings.

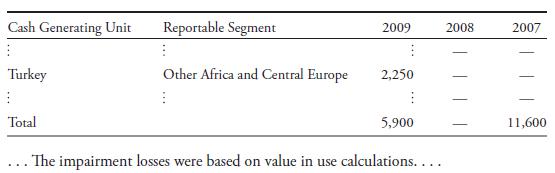

Excerpt from Note 10. Impairment Impairment losses

Impairment losses recognized in the consolidated income statement as a separate line item within operating profit, in respect of goodwill and licenses and spectrum fees are as follows (£m):

Turkey

. . . At 30 September 2008, the goodwill was impaired by £1,700 million. . . . During the second half of the 2009 financial year, impairment losses of £300 million in relation to goodwill and £250 million in relation to licenses and spectrum resulted from adverse changes in both the discount rate and a fall in the long-term GDP growth rate. The cash flow projections . . . were substantially unchanged from those used at 30 September 2008. . . .

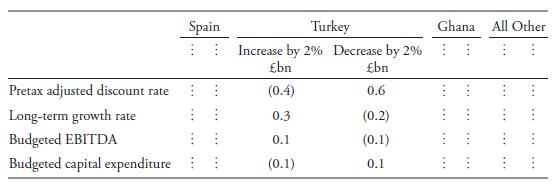

Sensitivity to changes in assumptions

. . . The estimated recoverable amount of the Group’s operations in Spain, Turkey, and Ghana equaled their respective carrying value and, consequently, any adverse change in key assumption would, in isolation, cause a further impairment loss to be recognized. . . .

The changes in the following table to assumptions used in the impairment review would, in isolation, lead to an (increase)/decrease to the aggregate impairment loss recognized in the year ended 31 March 2009:

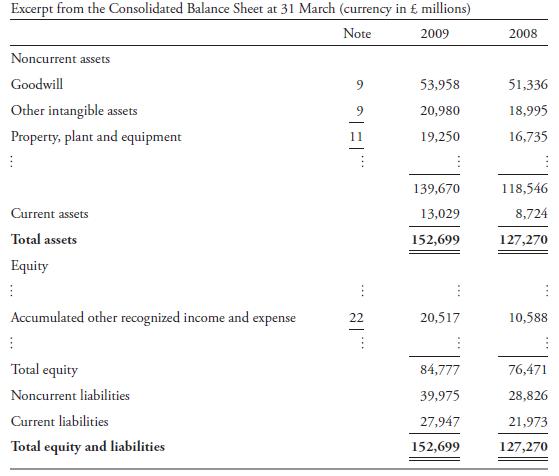

Excerpt from Note 11. Property, Plant, and Equipment The net book value of land and buildings and equipment, fixtures, and fittings includes £106 million and £82 million, respectively (2008: £110 million and £51 million) in relation to assets held under finance leases. Included in the net book value of land and buildings and equipment, fixtures and fittings are assets in the course of construction, which are not depreciated, with a cost of £44 million and £1,186 million, respectively (2008: £28 million and £1,013 million). Property, plant, and equipment with a net book value of £148 million (2008: £1,503 million) has been pledged as security against borrowings.

1. As of 31 March 2009, what percentage of other intangible assets and property, plant, and equipment is pledged as security against borrowings?

2. What caused the £250 million impairment losses in relation to licenses and spectrum during the year ended 31 March 2009?

3. By what amount would impairment losses related to Turkey change if the pretax adjusted discount rate decreased by 2 percent?

4. Where are impairment losses reported on the financial statements? Where is amortization included within the consolidated income statement?

5. What percentage of property, plant, and equipment, based on net book value, is held under finance leases rather than owned as of 31 March 2009?

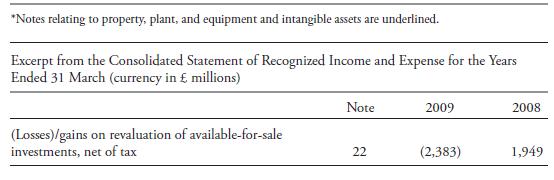

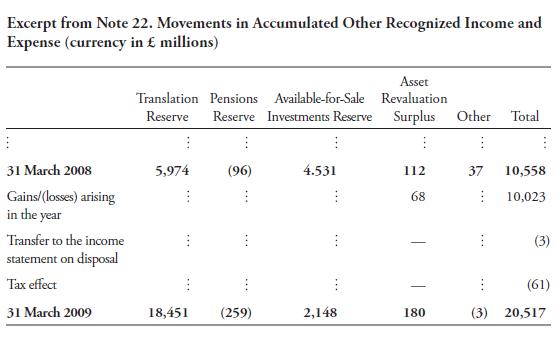

6. The gains and losses arising in the year on asset revaluation most likely are:

A. reflected on the consolidated income statement.

B. reported in the notes to the financial statements only.

C. recognized directly in equity and shown on the consolidated statement of recognized income and expense.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie