Earlier segments of this problem have described how Mary Graham created Echo Systems on October 1, 2020.

Question:

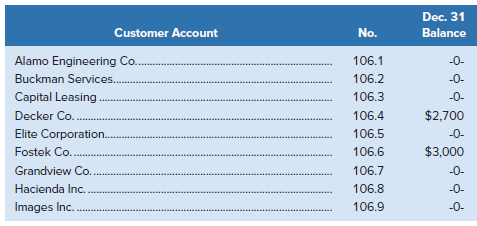

Earlier segments of this problem have described how Mary Graham created Echo Systems on October 1, 2020. The company has been successful, and its list of customers has started to grow. To accommodate the growth, the accounting system is ready to be modified to set up separate accounts for each customer. The following list of customers includes the account number used for each account and any balance as of the end of 2020. Graham decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This modification allows the existing chart of accounts to continue being used. The list also shows the balances that two customers owed as of December 31, 2020:

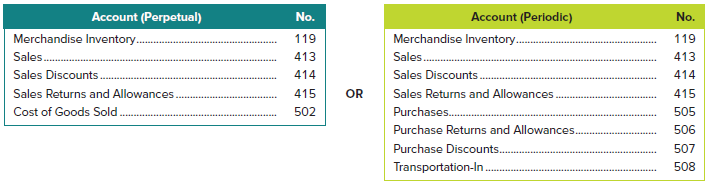

In response to frequent requests from customers, Graham has decided to begin selling computer software. The company will extend credit terms of 1/10, n/30 to customers who purchase merchandise. No cash discount will be available on consulting revenue. The following additional accounts were added to the general ledger to allow the system to account for the company?s new merchandising activities:

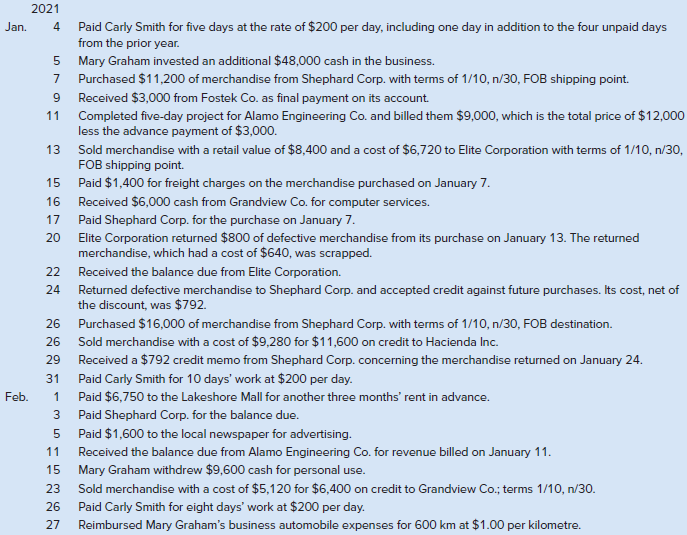

Because the accounting system does not use reversing entries, all revenue and expense accounts have zero balances as of January 1, 2021.

Required

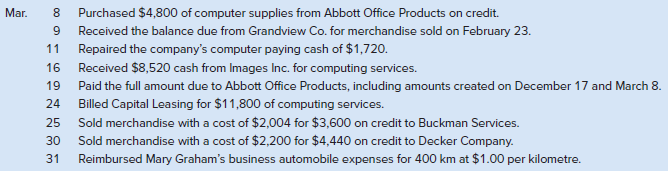

1. Prepare journal entries to record each of the following transactions for Echo Systems, assuming either a perpetual system or a periodic system.

2. Post the journal entries to the accounts in the company?s general ledger. (Use asset, liability, and equity accounts that start with balances as of December 31, 2020.)

3. Prepare a partial work sheet consisting of the first six columns showing the unadjusted trial balance, the March 31 adjustments described in (a) through (g) below, and the adjusted trial balance. Do not prepare closing entries and do not journalize the adjusting entries or post them to the ledger.

a. The March 31 computer supplies on hand is $4,230.

b. Three more months have passed since the company purchased the annual insurance policy at the cost of $4,320.

c. Carly Smith has not been paid for seven days of work.

d. Three months have passed since any prepaid rent cost has been transferred to expense. The monthly rent is $2,250.

e. Depreciation on the computer for January through March is $2,250.

f. Depreciation on the office equipment for January through March is $1,500.

g. The March 31 inventory of merchandise is $1,960.

4. Prepare an interim single-step income statement for the three months ended March 31, 2021. List all expenses without differentiating between selling expenses and general and administrative expenses.

5. Prepare an interim statement of changes in equity for the three months ended March 31, 2021.

6. Prepare an interim classified balance sheet as of March 31, 2021.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann