In March 2020, the management team of Londonderry Air (LA) met to discuss a proposal to purchase

Question:

In March 2020, the management team of Londonderry Air (LA) met to discuss a proposal to purchase five shorthaul aircraft at a total cost of $25 million. There was general enthusiasm for the investment, and the new aircraft were expected to generate an annual cash flow of $4 million for 20 years.

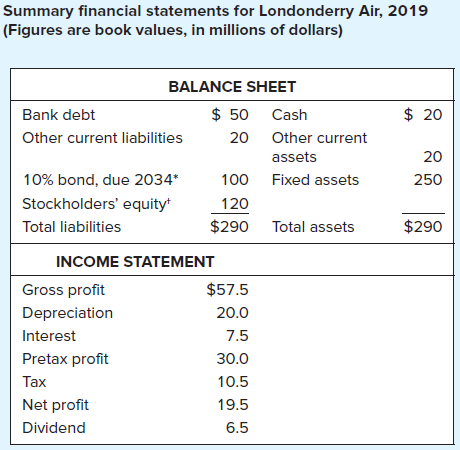

The focus of the meeting was on how to finance the purchase. LA had $20 million in cash and marketable securities (see table), but Ed Johnson, the chief financial officer, pointed out that the company needed at least $10 million in cash to meet normal outflow and as a contingency reserve. This meant that there would be a cash deficiency of $15 million, which the firm would need to cover either by the sale of common stock or by additional borrowing. While admitting that the arguments were finely balanced, Mr. Johnson recommended an issue of stock. He pointed out that the airline industry was subject to wide swings in profits and the firm should be careful to avoid the risk of excessive borrowing. He estimated that in market value terms, the long-term debt ratio was about 59% and that a further debt issue would raise the ratio to 62%.

Mr. Johnson?s only doubt about making a stock issue was that investors might jump to the conclusion that management believed the stock was overpriced, in which case the announcement mightprompt an unjustified selloff by investors. He stressed, therefore, that the company needed to explain carefully the reasons for the issue. Also, he suggested that demand for the issue would beenhanced if at the same time LA increased its dividend payment. This would provide a tangible indication of management?s confidence in the future.

These arguments cut little ice with LA?s chief executive. ?Ed,? she said, ?I know that you?re the expert on all this, but everything you say flies in the face of common sense. Why should we want tosell more equity when our stock has fallen over the past year by nearly a fifth? Our stock is currently offering a dividend yield of 6.5%, which makes equity an expensive source of capital. Increasing the dividend would simply make it more expensive. What?s more, I don?t see the point of paying out more money to the stockholders at the same time that we are asking them for cash. If we hike the dividend, we will need to increase the amount of the stock issue; so we will just be paying the higher dividend out of the shareholders? own pockets. You?re also ignoring the question of dilution. Our equity currently has a book value of $12 a share; it?s not playing fair by our existing shareholders if we now issue stock for around $10 a share.

?Look at the alternative. We can borrow today at 6%. We get a tax break on the interest, so with a 21% tax rate, the after-tax cost of borrowing is (1 ? .21) ? 6% = 4.74%. That?s less than the cost ofequity. We expect to earn a return of 15% on these new aircraft. If we can raise money at 4.74% and invest it at 15%, that?s a good deal in my book.

?You finance guys are always talking about risk, but as long as we don?t go bankrupt, borrowing doesn?t add any risk at all.

?Ed, I don?t want to push my views on this?after all, you?re the expert. We don?t need to make a firm recommendation to the board until next month. In the meantime, why don?t you get one of yournew business graduates to look at the whole issue of how we should finance the deal and what return we need to earn on these planes??

Use the most recently available financial data from 2019 to help evaluate Mr. Johnson?s arguments about the stock issue and dividend payment as well as the reply of LA?s chief executive. Who is correct? What is the required rate of return on the new planes?

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Dividend Yield

Dividend yield refers to a stock's annual dividend payments to shareholders, expressed as a percentage of the stock's current price. The dividend per share that a company pays divided by the share price. This is reported on the financial statements...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-1260566093

10th edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus