The Lumber Yard Ltd. competes with Hardesty Inc. in product lines such as hardwood flooring, noise-reducing underlay,

Question:

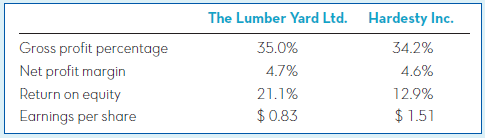

The Lumber Yard Ltd. competes with Hardesty Inc. in product lines such as hardwood flooring, noise-reducing underlay, and mouldings. Assume the two companies reported the following financial results in fiscal 2017:

Required:

1. Explain how The Lumber Yard Ltd. could have a substantially higher gross profit percentage than Hardesty Inc. but a nearly identical net profit margin. What does this suggest about the relative ability of the two companies to control operating expenses?

2. Explain how The Lumber Yard Ltd. could have a higher return on equity but lower earnings per share. What does this suggest about the companies? relative number of outstanding shares? What other explanations could account for this seemingly contradictory pattern?

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh