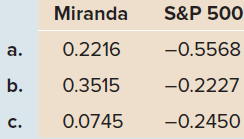

What is the Treynor measure for the Miranda Fund and the S&P 500? Kelli Blakely is a

Question:

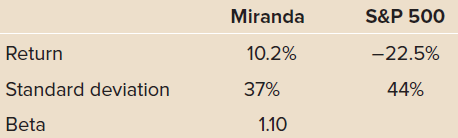

Kelli Blakely is a portfolio manager for the Miranda Fund, a core large-cap equity fund. The market proxy and benchmark for performance measurement is the S&P 500. Although the Miranda portfolio generally mirrors the S&P sector weightings,

Ms. Blakely is allowed a significant amount of flexibility. Ms. Blakely was able to produce exceptional returns last year (as outlined in the table below). Much of this performance is attributable to her pessimistic outlook, which caused her to change her asset class exposure to 50 percent stocks and 50 percent cash. The S&P€™s allocation was 97 percent stocks and 3 percent cash. The risk-free rate of cash returns was 2 percent.

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin