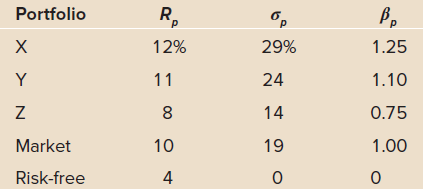

You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: What

Question:

What are the Sharpe ratio, Treynor ratio, and Jensen€™s alpha for each portfolio?

What are the Sharpe ratio, Treynor ratio, and Jensen€™s alpha for each portfolio?

Transcribed Image Text:

Portfolio R. 12% 29% 1.25 11 24 1.10 14 0.75 Market 10 19 1.00 Risk-free 4

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 78% (14 reviews)

Portfolio Sharpe ratio ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

You are given the following information concerning the relationship between the capital-labor ratio and output per person in eight situations: Capital-labor ratio Output per person (a) Suppose that...

-

You are given the following information concerning four stocks: a) Using 20X0 as the base year, construct three aggregate measures of the market that simulate the Dow Jones Industrial Average, the...

-

You are given the following information concerning two stocks that make up an index. What is the price-weighted return for theindex? Price per Share Shares Outstanding 53,000 62,000 End of Year $81...

-

You work as a manager in the admission department of company. You were asked by your department head to present and analyze the qualifying test scores of 40 employees who are applying for 5-year...

-

What is the net force on an object that is pulled with forces of 80 newtons to the right and 80 newtons to the left?

-

The following selected account balances are from LightHouse Distributors adjusted trial balance at September 30, 2021: Accounts payable ............................................ $ 90,000 Accounts...

-

Ethylene glycol at 100,000 \(\mathrm{lb} / \mathrm{hr}\) enters the shell of a 1-6 shell-and-tube heat exchanger at \(250^{\circ} \mathrm{F}\) and is cooled to \(130^{\circ} \mathrm{F}\) with cooling...

-

Data for two alternatives are as follows: If the MARR is 12%, compute the value of X that makes the two alternatives equally desirable. B Cost $800 $1000 Uniform annual benefit 230 230 Useful life,...

-

1. (6 points) What was the Civilian Labor Force in October 2023? What was the unemployment rate in October 2023? How many people not now in the labor force would have to enter the labor force...

-

In its fifth year of operations, Shocker, Inc., a C corporation, had current earnings and profits of $49,000. At the end of its fourth year of operations, accumulated earnings and profits were...

-

You find the monthly standard deviation of a stock is 8.60 percent. What is the annual standard deviation of the stock?

-

What is the Jensen alpha for the Miranda Fund? a. 0.2216 b. 0.3515 c. 0.0745 Kelli Blakely is a portfolio manager for the Miranda Fund, a core large-cap equity fund. The market proxy and benchmark...

-

What are the four types of responsibility centers? What is the focus of each of these responsibility centers?

-

What are the key challenges associated with implementing agile methodologies in traditionally hierarchical organizations, and how can they be mitigated ?

-

Juett Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 70,000 units per month is as follows: Direct...

-

Utilize ChatGPT and discuss the skills that CompTIA Project + cover, and share your findings.

-

Juan buys a bicycle in a sale. He gets a discount of 30% off the original price of 800 USD and pays 560 US dollars (USD). To buy the bicycle, Juan takes a loan of 560 USD for 6 months at a nominal...

-

An explosion breaks a 2 7 . 0 - kg object initially at rest into three parts. Part ( 1 ) has a mass m 1 = 3 . 6 0 - kg and a velocity of 5 0 . 0 m/s due west. Part ( 2 ) has a mass m 2 = 4 . 7 0 - kg...

-

Before adjustments and closing on December 31, 2017, the current accounts of Seymour and Associates indicated the following balances: The terms of an outstanding long-term note payable state that...

-

A superior criticized a sales manager for selling high-revenue, low-profit items instead of lower-revenue but higher-profit items. The sales manager responded, My income is based on commissions that...

-

In the CAPM, one of the assumptions is that investors have common (homogeneous) beliefs about the return distribution of assets. What is the common assumption about the asset return generating...

-

Assume that you are a U.S. investor buying a European stock: 1. You exchange 100 dollars for 90 euros at the exchange rate 1 USD = 0. 90 EUR or 1 EUR = 1. 11 USD. 2. You buy 10 shares of a European...

-

Write the market model form of Solniks IAPM. Solnik ran this model on 10 major industrialized countries from 1966 to 1971. What did he find? What did cross-sectional regression tests find? What did...

-

John Adams plans to retire at the age of 62. He wants an annual income of $60,000 per year. John is currently 45 years of age. How much does he have to place at the beginning of each year into a...

-

Assume that four years and one month from today you plan to make the first of several annual withdrawals from an account. Your first withdrawal will equal $1000. You plan for these withdrawals to...

-

If I borrowed 15,000 in student loans at an annual interest of 7%. and then repay $1800 per year, then how long will it take me to repay the loan?

Study smarter with the SolutionInn App