Pierce Company acquired a 90% interest in Sanders Company on January 1, 2026, for $1,480,000. At this

Question:

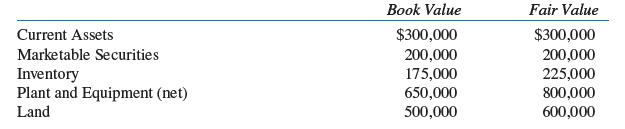

Pierce Company acquired a 90% interest in Sanders Company on January 1, 2026, for $1,480,000. At this time, Sanders Company’s common stock and retained earnings balances were $1,000,000 and $500,000, respectively. An examination of the books of Sanders on the date of purchase revealed the following:

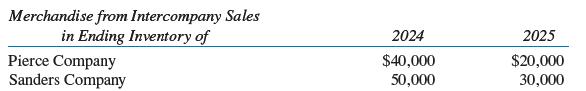

Sanders Company’s equipment has a remaining life of 10 years. Eighty percent of the inventory was sold in 2024, the remainder in 2025. During 2024, Pierce Company sold merchandise costing $400,000 to Sanders at a 25% markup on cost, and Sanders sold merchandise to Pierce Company for $100,000 (this price included $25,000 in profit). In 2025, Pierce Company sold merchandise to Sanders Company for $350,000, while Sanders Company sold merchandise to Pierce Company for $80,000. The 2024 markup percentages were also used on the 2025 sales. The selling price of intercompany merchandise remaining in ending inventories for both years is summarized here:

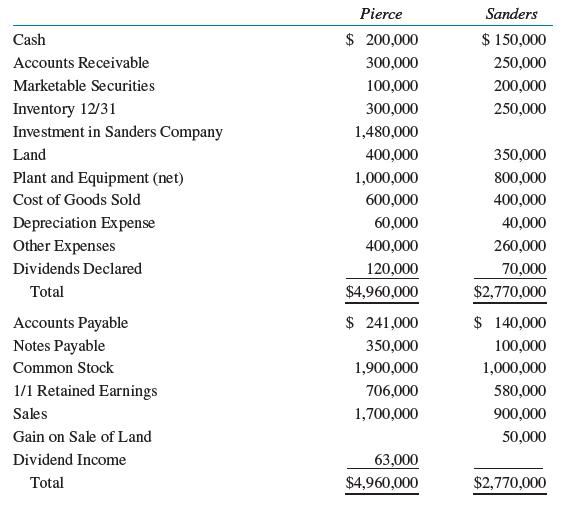

In 2025, Sanders Company also sold a piece of land that had a book value of $250,000 to Pierce Company for $300,000. On December 31, 2025, Pierce Company holds a $60,000 receivable on the merchandise it sold to Sanders Company. Adjusted trial balances for the year ended December 31, 2025 are shown here:

Required:

Prepare a consolidated statements workpaper for the year ended December 31, 2025.

Step by Step Answer: