Question: 6) Most financial crises in the United States have begun with A) a steep stock market decline. B) an increase in uncertainty resulting from

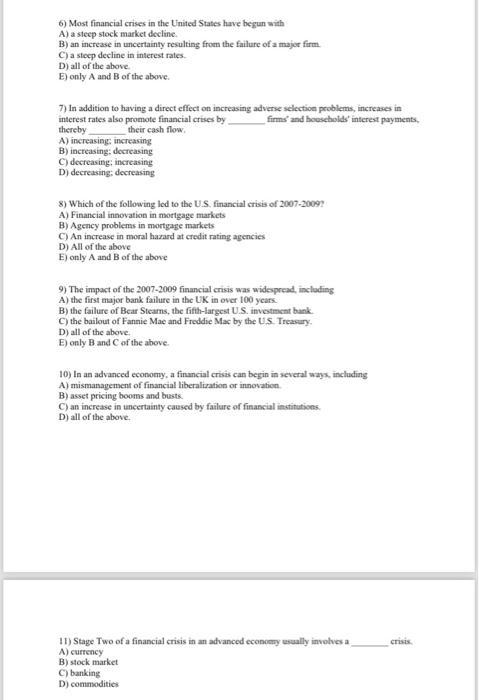

6) Most financial crises in the United States have begun with A) a steep stock market decline. B) an increase in uncertainty resulting from the failure of a major firm C) a steep decline in interest rates. D) all of the above. E) only A and B of the above. 7) In addition to having a direct effect on increasing adverse selection problems, increases in interest rates also promote financial crises by thereby firms and households' interest payments, their cash flow. A) increasing: increasing B) increasing: decreasing C) decreasing: increasing D) decreasing; decreasing 8) Which of the following led to the U.S. financial crisis of 2007-2009? A) Financial innovation in mortgage markets B) Agency problems in mortgage markets C) An increase in moral hazard at credit rating agencies D) All of the above E) only A and B of the above 9) The impact of the 2007-2009 financial crisis was widespread, including A) the first major bank failure in the UK in over 100 years. B) the failure of Bear Stearns, the fifth-largest U.S. investment bank C) the bailout of Fannie Mac and Freddie Mac by the U.S. Treasury. D) all of the above. E) only B and C of the above. 10) In an advanced economy, a financial crisis can begin in several ways, including A) mismanagement of financial liberalization or innovation. B) asset pricing booms and busts C) an increase in uncertainty caused by failure of financial institutions. D) all of the above. 11) Stage Two of a financial crisis in an advanced economy usually involves a A) currency B) stock market C) banking D) commodities crisis.

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Here are the answers to your questions about financial crises based on the information you provided 6 Most financial crises in the United S... View full answer

Get step-by-step solutions from verified subject matter experts