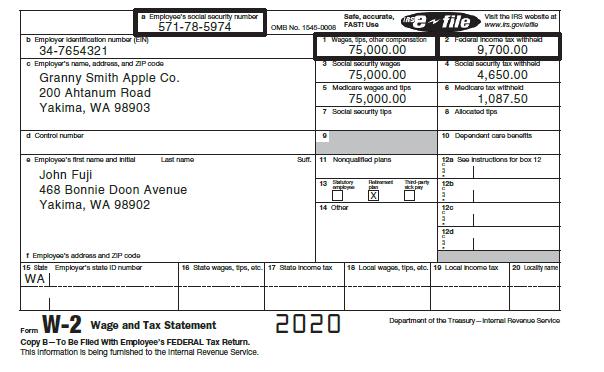

John Fuji (birthdate June 6, 1981) received the following Form W-2 from his employer related to his

Question:

John Fuji (birthdate June 6, 1981) received the following Form W-2 from his employer related to his job as a manager at a Washington apple-processing plant:

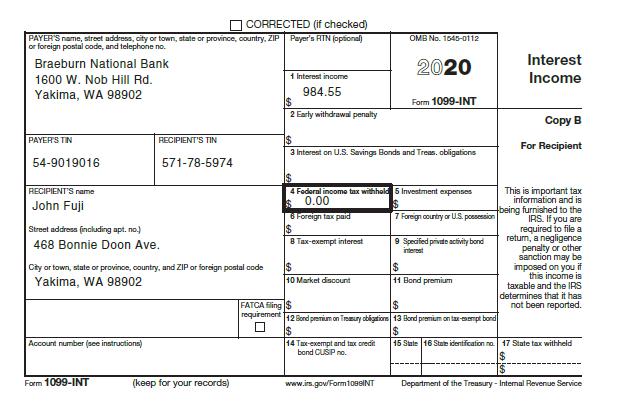

John’s other income includes interest on a Certificate of Deposit reported on a Form 1099-INT:

Also, in accordance with the January 2016 divorce decree he paid $500 per month alimony to his ex-wife (Dora Fuji, Social Security number 573-79-6075) in 2020.

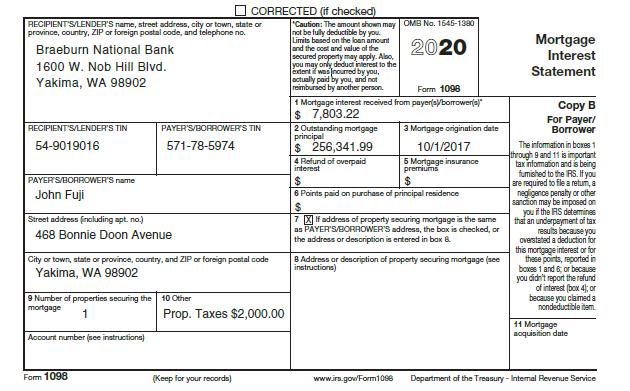

John received the following Form 1098 reporting mortgage interest and property taxes:

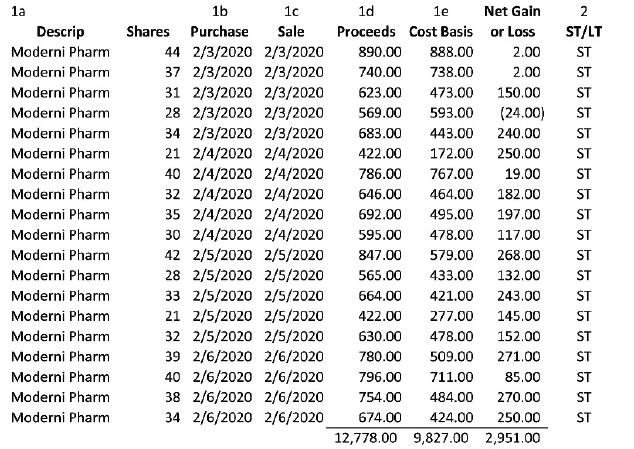

John tried his hand at day trading for one week in February 2020. He received a substitute Form 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required any adjustments or codes, these can be entered as a summary entry into Schedule D and no Form 8949 needs to be prepared.

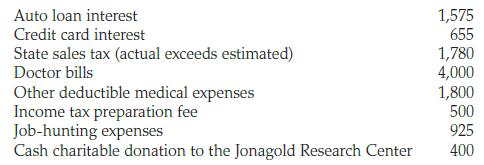

During 2020, John paid the following amounts (all of which can be substantiated):

John’s employer offers a retirement plan, but John does not participate. Instead, he made a $4,000 contribution to a Roth IRA.

John received a $1,200 EIP in 2020.

Required:

Complete John’s federal tax return for 2020. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill