Ingalls Corporation is in the process of negotiating a loan for expansion purposes. The books and records

Question:

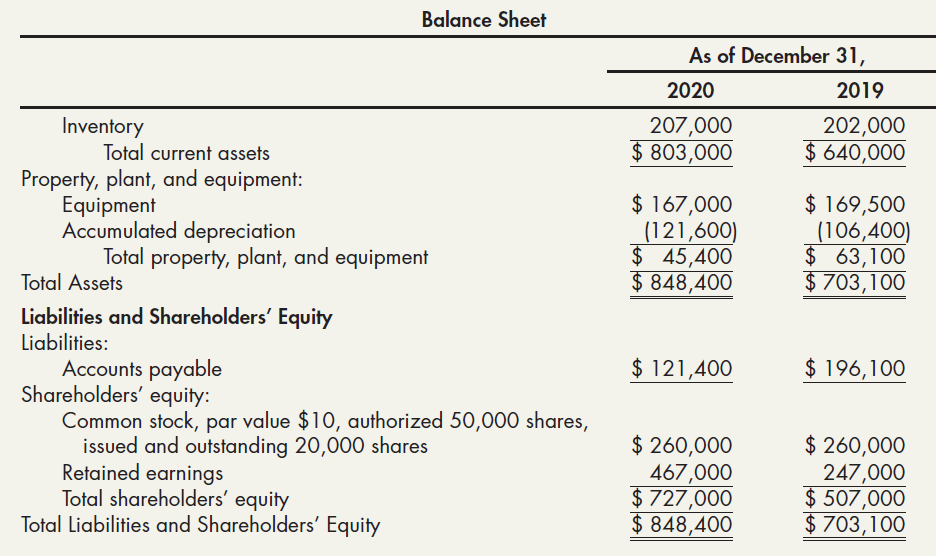

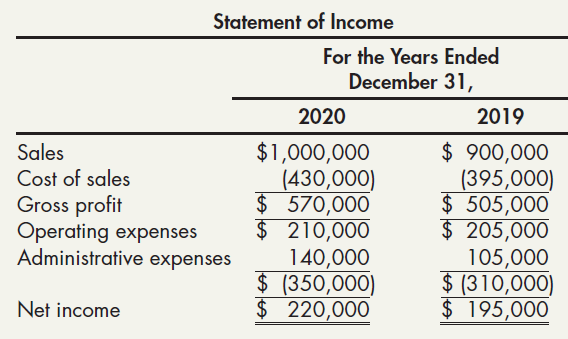

Ingalls Corporation is in the process of negotiating a loan for expansion purposes. The books and records have never been audited, and the bank has requested that an audit be performed. Ingalls has prepared the following comparative financial statements for the years ended December 31, 2020 and 2019:

During the course of the audit, the following additional facts were determined:

• An analysis of collections and losses on accounts receivable during the past 2 years indicates a drop in anticipated losses because of bad debts. After consultation with management, it was agreed that the loss experience rate on sales should be reduced from the recorded 2% to 1%, beginning with the year ended December 31, 2020.

• An analysis of the available-for-sale securities revealed that this portfolio consisted entirely of short-term investments in marketable securities that were acquired in 2019. The total market valuation for these investments as of the end of each year was as follows: December 31, 2019, $81,000; December 31, 2020, $62,000.

• The merchandise inventory at December 31, 2019, was overstated by $4,000, and the merchandise inventory at December 31, 2020, was overstated by $6,100.

• On January 2, 2019, equipment costing $12,000 (estimated useful life of 10 years and residual value of $1,000) was incorrectly charged to Operating Expenses. Ingalls records depreciation via the straight-line method. In 2020, fully depreciated equipment (with no residual value) that originally cost $17,500 was sold as scrap for $2,500. Ingalls credited the proceeds of $2,500 to Equipment.

• An analysis of 2019 operating expenses revealed that Ingalls charged to expense a 3-year insurance premium of $2,700 on January 15, 2019.

Required:

1. Prepare the journal entries to correct the books at December 31, 2020. The books for 2020 have not been closed. Ignore income taxes.

2. Prepare a schedule showing the computation of corrected net income for the years ended December 31, 2020 and 2019, assuming that any adjustments are to be reported on comparative statements for the 2 years. The first items on your schedule should be the net income for each year. Ignore income taxes. (Do not prepare financial statements.)

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach