Oilfield Multiservices Ltd. (OML) offers oilfield operation services to the oil and gas industry in Alberta and

Question:

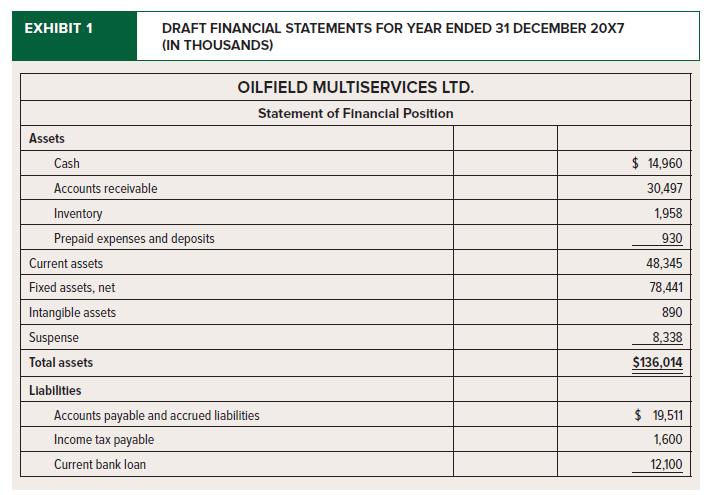

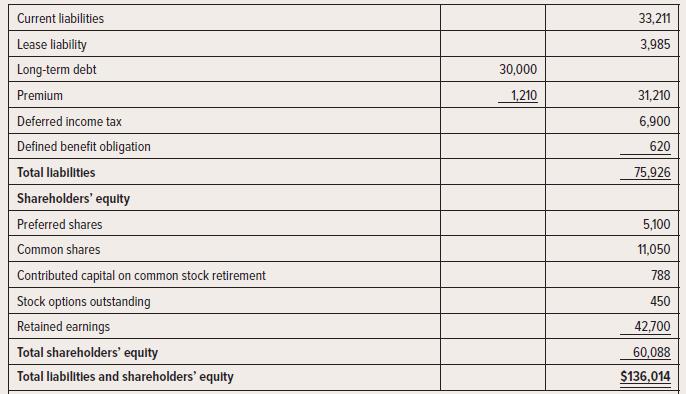

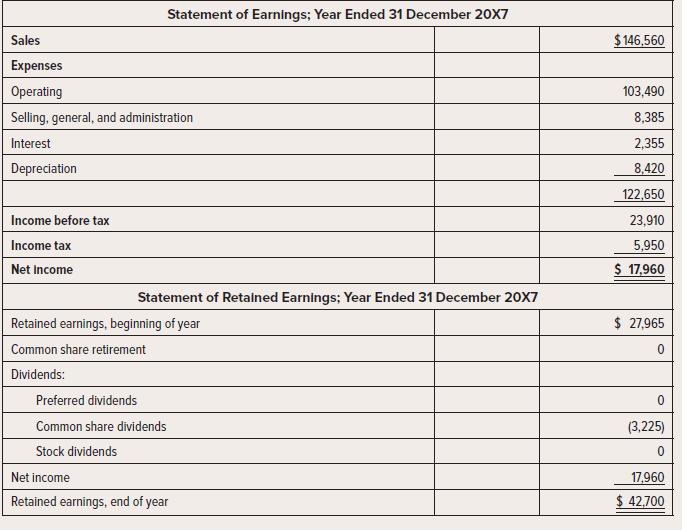

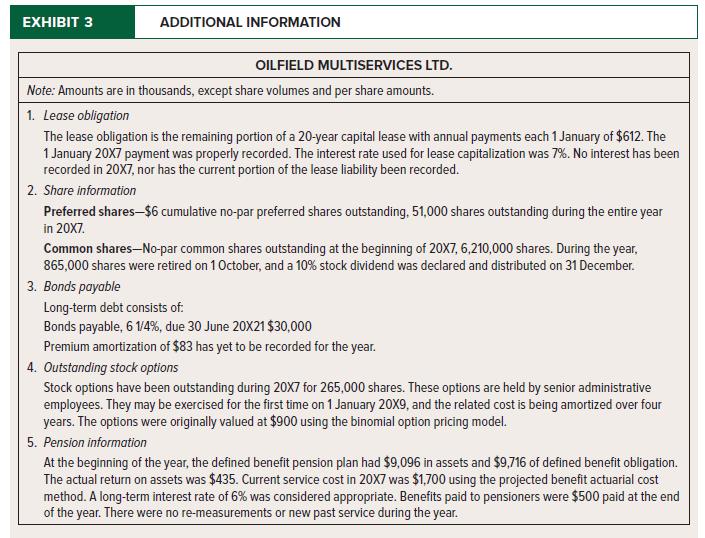

Oilfield Multiservices Ltd. (OML) offers oilfield operation services to the oil and gas industry in Alberta and Texas. OML owns no natural resource properties itself but assists in exploration activities through cementing and stimulation services. OML complies with ASPE. The company has prepared draft financial statements (Exhibit 1). However, some transactions during the year have not been properly reflected in the financial statements (Exhibit 2). Additional information on financial statement elements are provided in Exhibit 3. OML is required, as part of its bond agreement, to maintain a minimum level of retained earnings of $30 million, and a maximum debt-toequity ratio of 1.5. In the debt-to-equity ratio, the numerator is “total liabilities.” Since a number of the transactions that have not been processed affect debt and/or equity, the CFO is concerned that these key financial targets continue to be met.

Required:

1. Provide journal entries to account for the information provided in Exhibits 2 and 3. None of the adjustments mentioned alters income tax expense, income tax payable, or future income tax. Round all adjustments to the nearest thousand. All amounts are given in thousands, except share volumes and per share amounts.

2. Prepare a revised statement of financial position, statement of comprehensive income, and statement of retained earnings.

3. Evaluate the key financial targets and suggest action for the coming year if there are concerns.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel