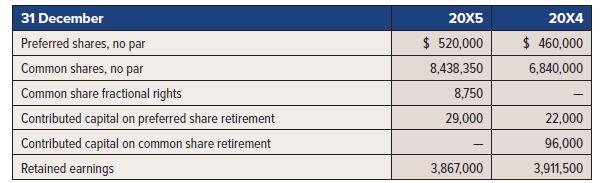

The following data relates to Ottawa Ltd.: Transactions during the year: 1. Preferred shares were issued for

Question:

The following data relates to Ottawa Ltd.:

Transactions during the year:

1. Preferred shares were issued for $100,000 during the year. Share issue costs of $2,000 were charged directly to retained earnings. Other preferred shares were retired.

2. On 31 December 20X4, there were 570,000 common shares outstanding.

3. A total of 20,000 common shares were retired on 2 January 20X5 for $18 per share.

4. There was a 10% stock dividend on 1 April 20X5. This dividend was capitalized at $17.50, the fair value of common shares. The stock dividend resulted in the issuance of fractional rights for 3,200 whole shares. Of these, 2,700 whole shares were subsequently issued and fractional rights for a remaining 500 shares are still outstanding at the end of the year.

5. Cash dividends were declared during the year.

6. Common shares were issued in June 20X5 for land. The transaction involved issuing 3,000 common shares for land valued at $52,000.

7. Common shares (46,000 shares) were issued for cash on 30 December 20X5.

8. Earnings were $1,200,000 in 20X5.

Required:

Prepare the financing activities section of the SCF, including dividends paid, based on the above information.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel