Question: Based on the information set out in problem PA-46 below, prepare the cash flows from operating activities section of the statement of cash flows using

Based on the information set out in problem PA-46 below, prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

Data from PA-46

Tymen Ltd.Income StatementFor the Year Ended December 31, 2019Sales ..................................................................................? ? $3,218,575Cost of goods sold ........................................................... ? ?1,649,125Gross profit .......................................................................? ? 1,569,450Depreciation of PPE .......................................................... ? ? 318,700Patent impairment ............................................................ ? ? ? 40,000Interest expense??bonds ................................................. ? ? ? 36,000Interest expense??finance lease ...................................... ? ? ? ?4,500Other expenses ..................................................................? ? ? 735,750Operating income ...............................................................? ? ?434,500Investment income??associate ......................................... ? 288,000Income before income taxes ............................................. ? 722,500Income taxes ....................................................................... ? ?293,000Net income .......................................................................... $ 429,500

Additional information:

- Tymen has adopted a policy of classifying cash inflows and outflows from interest and dividends as operating activities.

- Tymen did not elect to designate its at fair value through profit or loss investments as cash equivalents.

- Tymen accounts for its investment in an associate using the equity method.

- The company nets many items to ??Other Expenses??; for example, gains and losses on fixed asset sales.

- During the year Tymen acquired PPE with a fair value of $100,000 under a finance lease.

- 90,000 ordinary shares and 10,000 preferred shares were issued to acquire $110,000 of PPE.

- Tymen successfully defended its right to a patent. Related expenditures totalled $18,000.

- The decrease in the bonds payable account was due to the amortization of the premium.

- Property, plant, and equipment costing $420,000 was sold for $75,000.

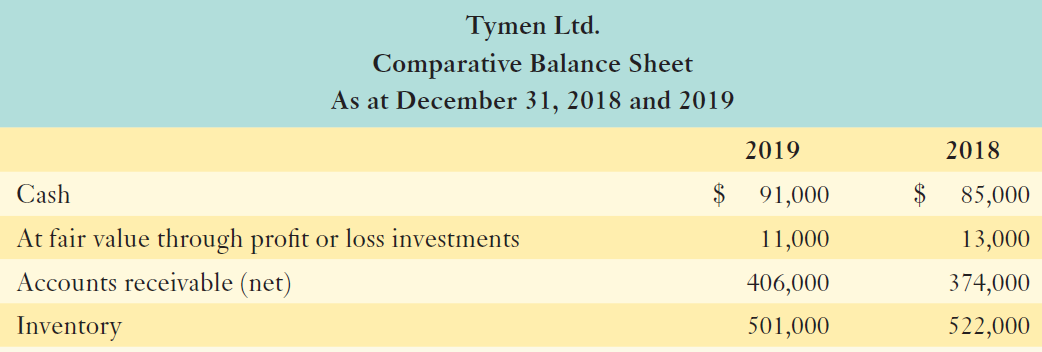

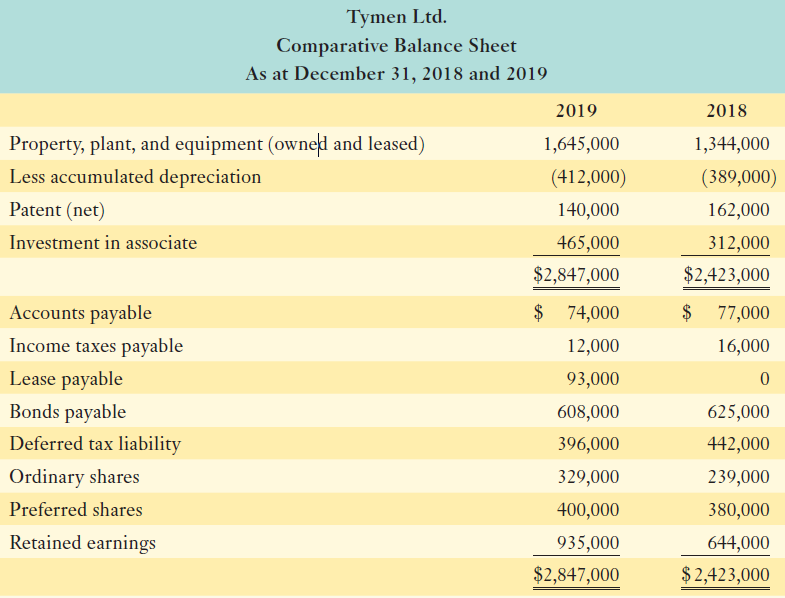

Tymen Ltd. Comparative Balance Sheet As at December 31, 2018 and 2019 2019 2018 Cash $ 91,000 $ 85,000 At fair value through profit or loss investments 11,000 13,000 Accounts receivable (net) 406,000 374,000 Inventory 501,000 522,000

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Tymen Ltd Statement of Cash Flows partial Year Ended Decemb... View full answer

Get step-by-step solutions from verified subject matter experts