Dr. Emma Armstrong, M.D., maintains the accounting records of the Blood Sugar Clinic on a cash basis.

Question:

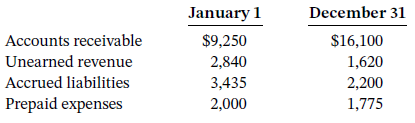

Dr. Emma Armstrong, M.D., maintains the accounting records of the Blood Sugar Clinic on a cash basis. During 2020, Dr. Armstrong collected $146,000 in revenues and paid $55,470 in expenses. At January 1, 2020, and December 31, 2020, she had accounts receivable, unearned revenue, accrued liabilities, and prepaid expenses as follows (all long-lived assets are rented):

Instructions

Last week, Dr. Armstrong asked you, her CPA, to help her determine her income on the accrual basis. Write a letter to her explaining what you did to calculate net income on the accrual basis. Be sure to state net income on the accrual basis and to include a schedule of your calculations.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy