Question: Silvio's Taverns, Inc. adopted the dollar-value LIFO Method in 2015. Information related to Silvio's inventory follows: Required a. Compute Silvio's ending inventory under the dollar-value

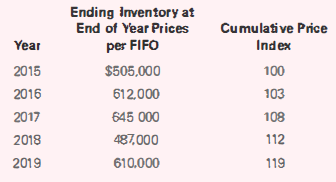

Silvio's Taverns, Inc. adopted the dollar-value LIFO Method in 2015. Information related to Silvio's inventory follows:

Required

a. Compute Silvio's ending inventory under the dollar-value LIFO method for the years 2015 through 2019.

b. Prepare the journal entries for 2016 through 2019 to adjust inventory to the dollar-value LIFO basis.

c. Determine the ending balance of the LIFO reserve for 2016 through 2019.

Ending Inventory at End of Year Prices Cumulative Price per FIFO Year Index $505,000 2015 100 2016 103 612,000 2017 645 000 108 487,000 112 2018 610.000 2019 119

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

a Year Ending Inventory at End of Year Prices per Internal Books Cumulative Price Index Ending Inven... View full answer

Get step-by-step solutions from verified subject matter experts