The following information relates to the accounting income for Alberta Real Estate Company (AREC) for the current

Question:

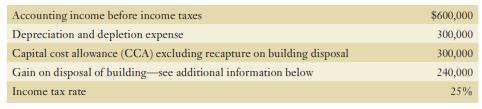

The following information relates to the accounting income for Alberta Real Estate Company (AREC) for the current year ended December 31:

During the year, the company sold one of its buildings with a carrying value of $720,000 for proceeds of $960,000, resulting in an accounting gain of $240,000. This gain has been included in the pre-tax income figure of $600,000 shown above. For tax purposes, the acquisition cost of the building was $800,000. For purposes of CCA, it is a Class 1 asset, which treats each building as a separate class. The undepreciated capital cost on the building at the time of disposal was $600,000.

Required:

Prepare the journal entries to record income taxes for AREC.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: