We have seen how to apply the CreditMetrics methodology to a single risky bond, to apply the

Question:

We have seen how to apply the CreditMetrics methodology to a single risky bond, to apply the ideas to a portfolio of risky bonds is significantly harder since it requires the knowledge of any relationship between the different bonds. This is most easily measured by some sort of correlation.

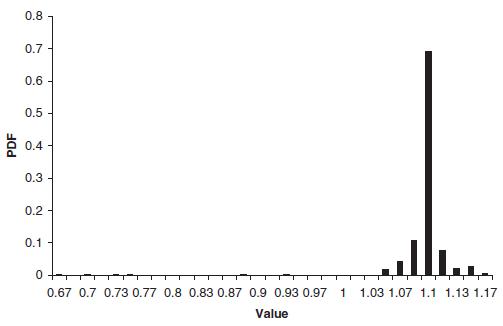

Suppose that we have a portfolio of two bonds. One, issued by ABC, is currently rated AA and the other, issued by XYZ, is BBB. We can calculate, using the method above, the value of each of these bonds at our time horizon for each of the possible states of the two bonds. If we assume that each bond can be in one of eight states (AAA, AA, . . . , CCC, Default) there are 82 = 64 possible joint states at the time horizon. To calculate the expected value of our portfolio and standard deviation we need to know the probability of each of these joint states occurring. This is where the correlation comes in. There are two stages to determining the probability of any particular future joint state:

1. Calculate the correlations between bonds.

2. Calculate the probability of any joint state.

Step by Step Answer: