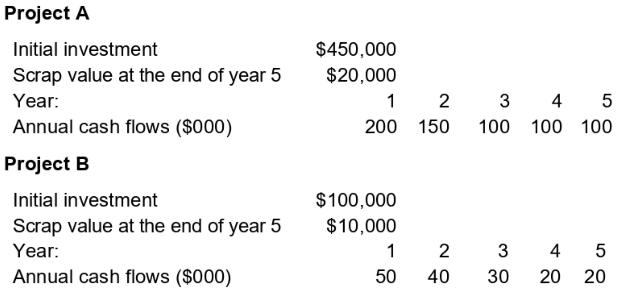

Question: Mickey Ltd is considering two mutually-exclusive projects with the following details: Assume that the initial investment is at the start of the project and the

Mickey Ltd is considering two mutually-exclusive projects with the following details:

Assume that the initial investment is at the start of the project and the annual cash flows are at the end of each year.

Which project should the company select, if the objective is to minimise the payback period?

A. Project $\mathrm{A}$

B. Project B

C. Either project $A$ or project $B$, as they have the same payback period

D. Neither project

Project A Initial investment $450,000 Scrap value at the end of year 5 $20,000 Year: 1 2 3 4 5 Annual cash flows ($000) 200 150 100 100 100 Project B Initial investment $100,000 Scrap value at the end of year 5 $10,000 Year: 1 2 Annual cash flows ($000) 50 40 30 20 20 42 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts