Question: For the dynamic Arrow-Hurwicz model in a discrete-time version from Exercise 4 with logarithmic utility functions of traders and the Walrasian equilibrium price vector known

For the dynamic Arrow-Hurwicz model in a discrete-time version from Exercise 4 with logarithmic utility functions of traders and the Walrasian equilibrium price vector known from Exercise 2 determine a feasible price trajectory for a few subsequent periods taking some value of parameter ; = o > 0. Present a geometric illustration of this trajectory in the state space and in the phase space.

Exercise 4

Define the dynamic Arrow-Hurwicz model in a discrete-time and in a continuous-time versions, taking as the basis the static Arrow-Hurwicz model from Exercise 2 with logarithmic and subadditive utility functions of traders.

Exercise 2

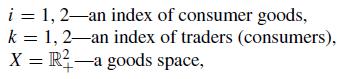

There is given a market of two traders and two goods described by the static Arrow-Hurwicz model, in which:

![]()

i = 1, 2-an index of consumer goods, k= 1, 2-an index of traders (consumers), X = R2-a goods space,

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts