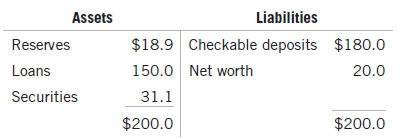

In the following bank balance sheet, amounts are in millions of dollars. The required reserve ratio is

Question:

a. Calculate the bank€™s excess reserves.

b. Suppose that the bank sells $5 million in securities to an investor. Show the bank€™s balance sheet after this transaction. Now what are the bank€™s excess reserves?

c. Suppose that the bank loans its excess reserves in part (b) to a local business. Show the bank€™s balance sheet after the loan has been made but before the business has spent the proceeds of the loan. Now what are the bank€™s excess reserves?

d. Suppose that the business spends the amount of the loan by writing a check. Revise the bank€™s balance sheet and calculate its excess reserves after the check has cleared.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Money, Banking, and the Financial System

ISBN: 978-0134524061

3rd edition

Authors: R. Glenn Hubbard, Anthony Patrick O'Brien

Question Posted: