Tantor Supply, Inc., is a small corporation acting as the exclusive distributor of a major line of

Question:

Tantor Supply, Inc., is a small corporation acting as the exclusive distributor of a major line of sporting goods. During 2010 the firm earned $92,500 before taxes.

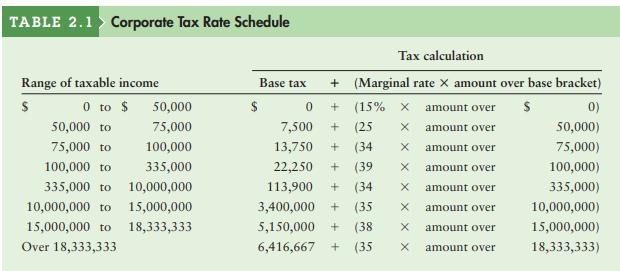

a. Calculate the firm’s tax liability using the corporate tax rate schedule given in Table 2.1.

b. How much are Tantor Supply’s 2010 after-tax earnings?

c. What was the firm’s average tax rate, based on your findings in part a?

d. What is the firm’s marginal tax rate, based on your findings in part a?

Table 2.1:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted: