Question: The accountant at Canton Manufacturing Company wants you to create an application that calculates an assets annual depreciation using the double-declining balance and sum-of-the-years digits

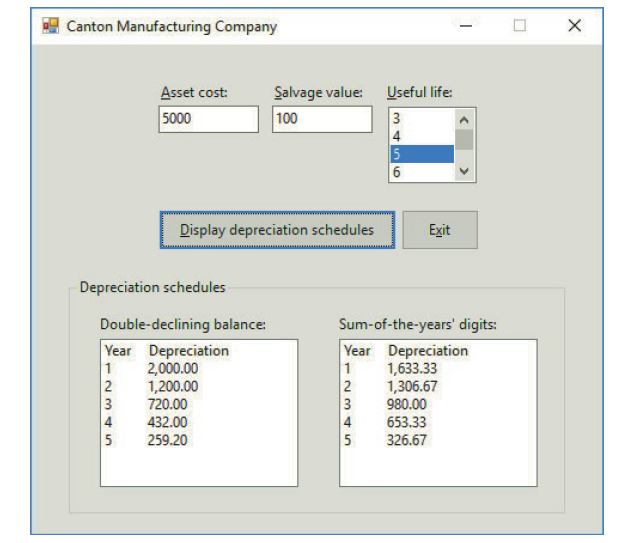

The accountant at Canton Manufacturing Company wants you to create an application that calculates an asset’s annual depreciation using the double-declining balance and sum-of-the-years’ digits methods. The accountant will enter the asset’s cost, useful life (in years), and salvage value (which is the value of the asset at the end of its useful life). A sample run of the application is shown in Figure 5-51. The interface provides text boxes for entering the asset cost and salvage value. It also provides a list box for selecting the useful life, which ranges from 3 through 20 years. The depreciation amounts are displayed in list boxes. (You can use the DDB and SYD functions in Microsoft Excel to verify that the amounts shown in Figure 5-51 are correct.) Create a Windows Forms application. Use the following names for the project and solution, respectively: Canton Project and Canton Solution. Save the application in the VB2017\Chap05 folder. You can use Visual Basic’s Financial.DDB method to calculate the double-declining balance depreciation, and use its Financial.SYD method to calculate the sum-of-the-years’ digits depreciation. The Financial.DDB method’s syntax is Financial.DDB(cost, salvage, life, period). The Financial.SYD method’s syntax is Financial.SYD(cost, salvage, life, period). In both syntaxes, the cost, salvage, and life arguments are the asset’s cost, salvage value, and useful life, respectively. The period argument is the period for which you want the depreciation amount calculated. Both methods return the depreciation amount as a Double number. Code the application. Save the solution and then start and test the application.

Canton Manufacturing Company Asset cost: Salvage value: Useful life: 100 5000 3 4 Display depreciation schedules Exit Depreciation schedules Sum-of-the-years' digits: Double-declining balance: Year Depreciation 1,633.33 1,306.67 980.00 653.33 326.67 Year Depreciation 2,000.00 1,200.00 720.00 432.00 259.20 2 2 4 4 5

Step by Step Solution

3.55 Rating (172 Votes )

There are 3 Steps involved in it

Microsoft Visual Studio Solution File Format Version 1200 Visual Studio 15 VisualStudioVer... View full answer

Get step-by-step solutions from verified subject matter experts