Question: 1) (30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next

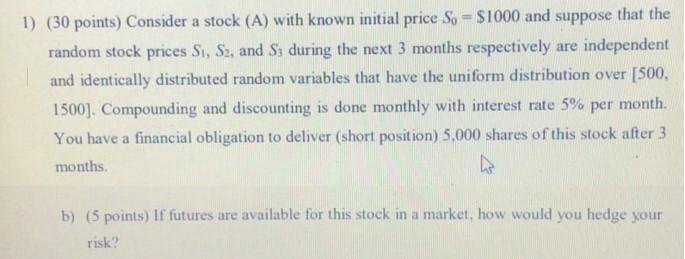

1) (30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next 3 months respectively are independent and identically distributed random variables that have the uniform distribution over [500, 1500]. Compounding and discounting is done monthly with interest rate 5% per month. You have a financial obligation to deliver (short position) 5,000 shares of this stock after 3 months. b) (5 points) If futures are available for this stock in a market, how would you hedge your risk? 1) (30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next 3 months respectively are independent and identically distributed random variables that have the uniform distribution over [500, 1500]. Compounding and discounting is done monthly with interest rate 5% per month. You have a financial obligation to deliver (short position) 5,000 shares of this stock after 3 months. b) (5 points) If futures are available for this stock in a market, how would you hedge your risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts