Question: ( 30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next

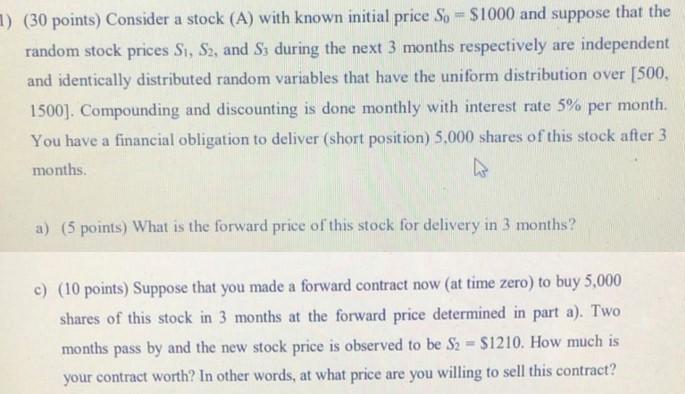

( 30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next 3 months respectively are independent and identically distributed random variables that have the uniform distribution over [500, 1500]. Compounding and discounting is done monthly with interest rate 5% per month. You have a financial obligation to deliver (short position) 5,000 shares of this stock after 3 months. a) (5 points) What is the forward price of this stock for delivery in 3 months? c) (10 points) Suppose that you made a forward contract now (at time zero) to buy 5,000 shares of this stock in 3 months at the forward price determined in part a). Two months pass by and the new stock price is observed to be S2=$1210. How much is your contract worth? In other words, at what price are you willing to sell this contract? ( 30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next 3 months respectively are independent and identically distributed random variables that have the uniform distribution over [500, 1500]. Compounding and discounting is done monthly with interest rate 5% per month. You have a financial obligation to deliver (short position) 5,000 shares of this stock after 3 months. a) (5 points) What is the forward price of this stock for delivery in 3 months? c) (10 points) Suppose that you made a forward contract now (at time zero) to buy 5,000 shares of this stock in 3 months at the forward price determined in part a). Two months pass by and the new stock price is observed to be S2=$1210. How much is your contract worth? In other words, at what price are you willing to sell this contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts