Question: 1. A developer called GAEBAAL company is advertising two separate construction projects to receive bids. One is called GoodMorningCity, and the other is called GoodEvenvingCity.

1. A developer called GAEBAAL company is advertising two separate construction projects to receive bids. One is called GoodMorningCity, and the other is called GoodEvenvingCity. Both are office building projects that have well-developed project scope and documents. You are the chief financial officer of a construction company called SIGONG which is interested in the two construction projects. SIGONG already spent some time and efforts to understand the following conditions for each project:

The Conditions for GoodMorningCity Project

| ACTIVITY | DURATION | DIRECT COST | DEPENDS ON |

|---|---|---|---|

| A | 30 DAYS | $15,000 | --- |

| B | 20 DAYS | $10,000 | --- |

| C | 30 DAYS | $30,000 | A,B |

| D | 30 DAYS | $30,000 | A,B |

| E | 10 DAYS | $5,000 | C |

| F | 30 DAYS | $15,000 | C |

| G | 15 DAYS | $15,000 | C |

| H | 15 DAYS | $15,000 | D |

| I | 20 DAYS | $5,000 | E |

| J | 15 DAYS | $15,000 | F,G,H |

| K | 15 DAYS | $30,000 | I,J |

SIGONG wants to finish the project as soon as possible. There is no holiday or weekend. One month is composed of 30 days. There are 8 working hours per day. The project starts at day 1. The direct costs are evenly distributed across the duration of the activity. Daily cost of indirect charges is $200. SIGONG wants to have 10% markup. GAEBAAL company wants to maintain 10% retainage policy until the completion of the construction. Payment requests are submitted at the end of each month, and payments are received one month later. Finance charge is 1% per month of the amount of the overdraft at the end of the month. Deposit on the overdraft account does not accrue interest.

The conditions for GoodEveningCity project are reflected in the following table:

(a) Since SIGONG is currently out of cash, you are trying to figure out the proper size of the line of credit that needs to be established for the construction of GoodMorningCity. Calculate the peak financial requirement based on the above project conditions. (b) Assuming 3% monthly interest, what is the Net Present Value of GoodMorningCity project? (c) Calculate the Net Present Value of GoodEveningCity project assuming: 3% monthly interest rate GoodEveningCity and GoodMorningCity both have the same project start date If SIGONG has to choose one of the two projects (GoodMorningCity and GoodEveningCity) due to lack of resources, which project would you recommend based on the NPV analyses? (d) The chief executive officer of SIGONG is seriously considering the idea of conducting both of the two projects: GoodMorningCity and GoodEveningCity. As the chief financial officer, you are now required to figure out the peak financial requirement on the company level. Assuming that there is no other project in the near future, draw the composite overdraft profile for the next six month period, and calculate the peak financial requirement.

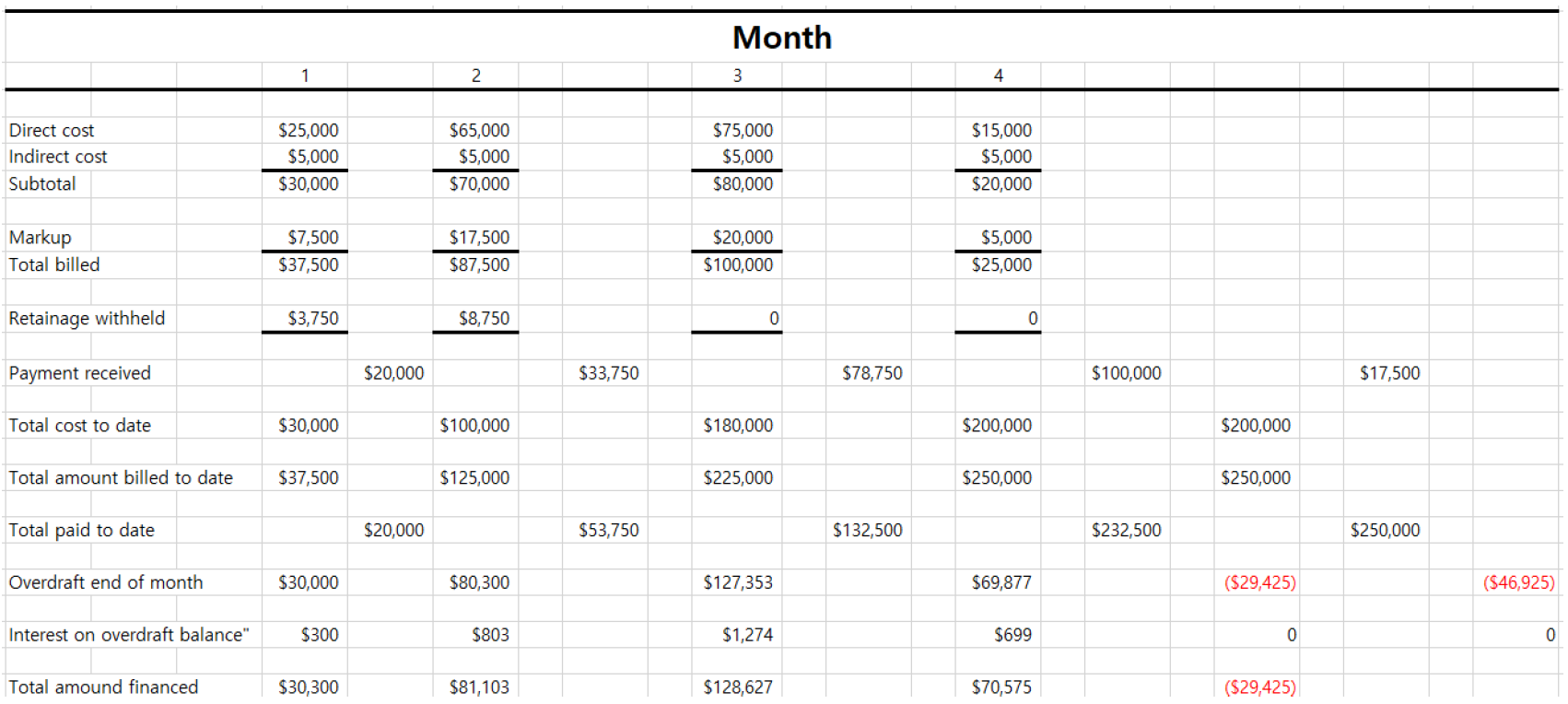

Month 1 2 3 4 Direct cost Indirect cost Subtotal $25,000 $5,000 $30,000 $65,000 $5,000 $70,000 $75,000 $5,000 $80,000 $15,000 $5,000 $20,000 Markup Total billed $7,500 $37,500 $17,500 $87,500 $20,000 $100,000 $5,000 $25,000 Retainage withheld $3,750 $8,750 0 0 Payment received $20,000 $33,750 $78,750 $100,000 $17,500 Total cost to date $30,000 $100,000 $180,000 $200,000 $200,000 Total amount billed to date $37,500 $125,000 $225,000 $250,000 $250,000 Total paid to date $20,000 $53,750 $132,500 $232,500 $250,000 Overdraft end of month $30,000 $80,300 $127,353 $69,877 ($29,425) (546,925) Interest on overdraft balance" $300 $803 $1,274 $699 0 0 Total amound financed $30,300 $81,103 $128,627 $70,575 ($29,425) Month 1 2 3 4 Direct cost Indirect cost Subtotal $25,000 $5,000 $30,000 $65,000 $5,000 $70,000 $75,000 $5,000 $80,000 $15,000 $5,000 $20,000 Markup Total billed $7,500 $37,500 $17,500 $87,500 $20,000 $100,000 $5,000 $25,000 Retainage withheld $3,750 $8,750 0 0 Payment received $20,000 $33,750 $78,750 $100,000 $17,500 Total cost to date $30,000 $100,000 $180,000 $200,000 $200,000 Total amount billed to date $37,500 $125,000 $225,000 $250,000 $250,000 Total paid to date $20,000 $53,750 $132,500 $232,500 $250,000 Overdraft end of month $30,000 $80,300 $127,353 $69,877 ($29,425) (546,925) Interest on overdraft balance" $300 $803 $1,274 $699 0 0 Total amound financed $30,300 $81,103 $128,627 $70,575 ($29,425)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts