Question: 1. Develop a pro forma income statement and balance sheet for Wal-Mart for the fiscal year ending January 31, 2006. Assume the following (in addition

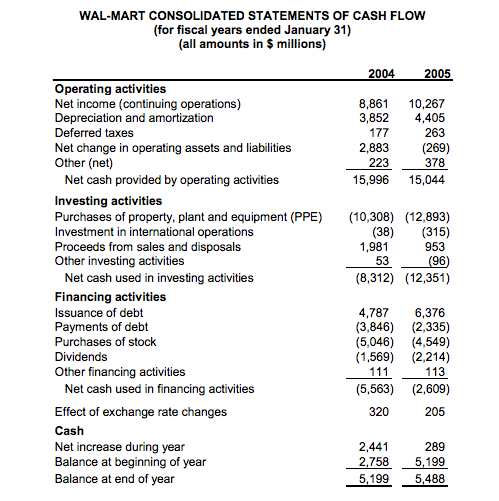

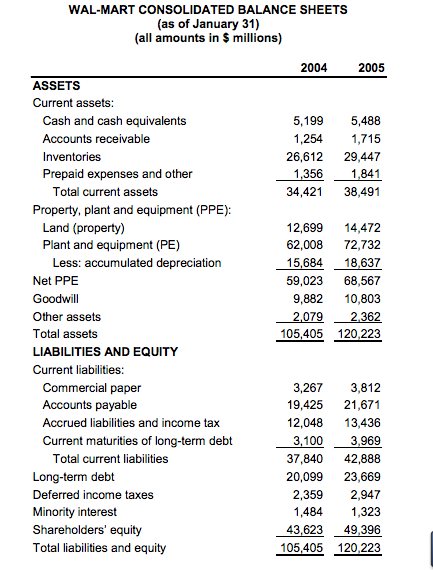

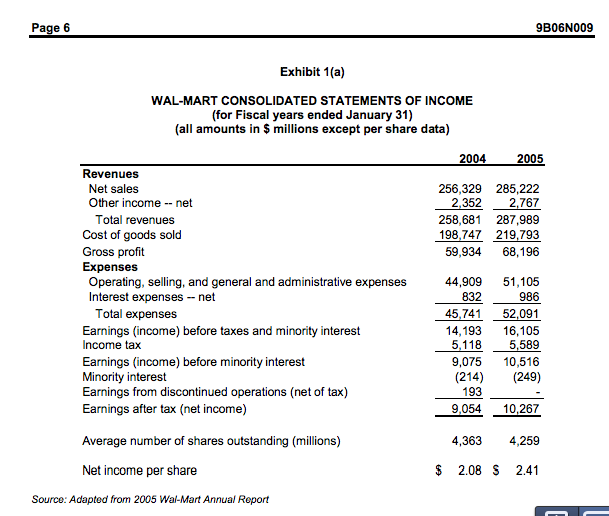

1. Develop a pro forma income statement and balance sheet for Wal-Mart for the fiscal year ending January 31, 2006. Assume the following (in addition to the information provided in the case): selling, general and administrative expenses at 17.3 percent of anticipated net sales; interest on debt at an average rate of four percent; no change in the number of shares outstanding as of January 31, 2005; no change in prepaid and other current assets, other assets, accrued liabilities, deferred income tax, or minority from the January 31, 2005 levels. State any other key assumptions. How profitable do you anticipate Wal-Mart will be? Will Wal-Mart need to increase its reliance on external borrowing?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts