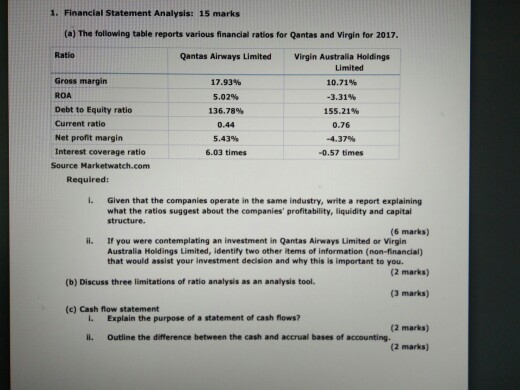

Question: 1. Financial Statement Analysis: 15 marks (a) The following table reports various financial ratios for Qantas and Virgin for 2017. Ratio Qantas Airways Limited Virgin

1. Financial Statement Analysis: 15 marks (a) The following table reports various financial ratios for Qantas and Virgin for 2017. Ratio Qantas Airways Limited Virgin Australia Holdings Limited Gross margin ROA Debt to Equity ratio Current ratio Net profit margin Interest coverage ratio 17.93% 5.02% 136.78% 0.44 5.43% 6.03 times 10.71% -3.31% 155.21% 0.76 -4.37% -0.57 times Source Marketwatch.com Required: I. Given that the companies operate in the same industry, write a report explaining what the ratios suggest about the companies' profitability, liquidity and capital structure. (6 marks) ii. If you were contemplating an investment in Qantas Airways Limited or Virgin Australia Holdings Limited, identify two other items of information (non-financial) that would assist your investment dedision and why this is important to you. (2 marks) (b) Discuss three limitations of ratio analysis as an analysis tool. (3 marks) (c) Cash flow statement I. Explain the purpose of a statement of cash flows? (2 marks) il. Outline the difference between the cash and accrual bases of accounting. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts