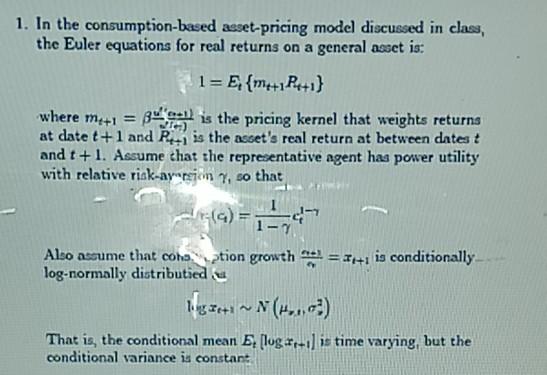

Question: 1. In the consumption-based asset-pricing model discussed in class, the Euler equations for real returns on a general awet is: 1=E{m++1 Pik+1} where Me+1 B

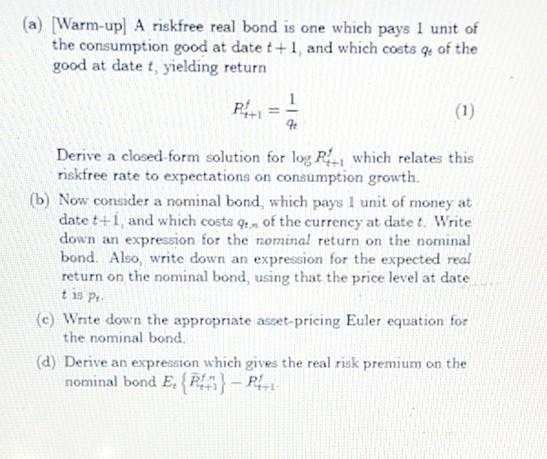

1. In the consumption-based asset-pricing model discussed in class, the Euler equations for real returns on a general awet is: 1=E{m++1 Pik+1} where Me+1 B is the pricing kernel that weights returns at date t+1 and is the asset's real return at between datest and t + 1. Assume that the representative agent has power utility with relative risk-araron 7, so that (q) = Torta Also assume that como ption growth = 31+ is conditionally log-normally distributiedu That is the conditional mean Elog #r-1] is time varying, but the conditional variance is constant PAL (a) (Warm-up) A riskfree real bond is one which pays I unit of the consumption good at date t+1, and which costs qe of the good at date t yielding return 1 (1) 94 Derive a closed form solution for log , which relates this riskfree rate to expectations on consumption growth. (b) Now consider a nominal bond, which pays 1 unit of money at date t+i, and which costs Gen of the currency at date. Write down an expression for the nominal return on the nominal bond. Also, write down an expression for the expected rea! return on the nominal bond, using that the price level at date t 15 P (c) Wnte down the appropriate asset pricing Euler equation for the nominal bond. (d) Derive an expression which gives the real risk premium on the nominal bond E. Ram} - Pl_2 1. In the consumption-based asset-pricing model discussed in class, the Euler equations for real returns on a general awet is: 1=E{m++1 Pik+1} where Me+1 B is the pricing kernel that weights returns at date t+1 and is the asset's real return at between datest and t + 1. Assume that the representative agent has power utility with relative risk-araron 7, so that (q) = Torta Also assume that como ption growth = 31+ is conditionally log-normally distributiedu That is the conditional mean Elog #r-1] is time varying, but the conditional variance is constant PAL (a) (Warm-up) A riskfree real bond is one which pays I unit of the consumption good at date t+1, and which costs qe of the good at date t yielding return 1 (1) 94 Derive a closed form solution for log , which relates this riskfree rate to expectations on consumption growth. (b) Now consider a nominal bond, which pays 1 unit of money at date t+i, and which costs Gen of the currency at date. Write down an expression for the nominal return on the nominal bond. Also, write down an expression for the expected rea! return on the nominal bond, using that the price level at date t 15 P (c) Wnte down the appropriate asset pricing Euler equation for the nominal bond. (d) Derive an expression which gives the real risk premium on the nominal bond E. Ram} - Pl_2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts