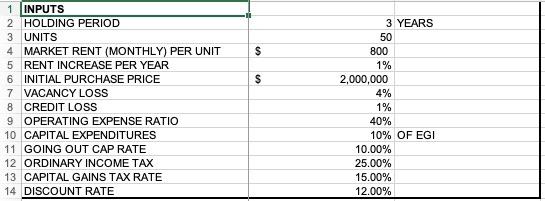

Question: $ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7

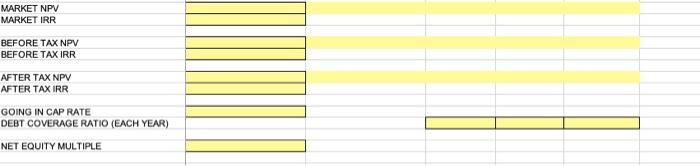

$ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7 VACANCY LOSS 8 CREDIT LOSS 9 OPERATING EXPENSE RATIO 10 CAPITAL EXPENDITURES 11 GOING OUT CAP RATE 12 ORDINARY INCOME TAX 13 CAPITAL GAINS TAX RATE 14 DISCOUNT RATE 3 YEARS 50 800 1% 2,000,000 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% MARKET NPV MARKET IRR BEFORE TAX NPV BEFORE TAX IRR AFTER TAX NPV AFTER TAXIRR GOING IN CAP RATE DEBT COVERAGE RATIO (EACH YEAR) NET EQUITY MULTIPLE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts