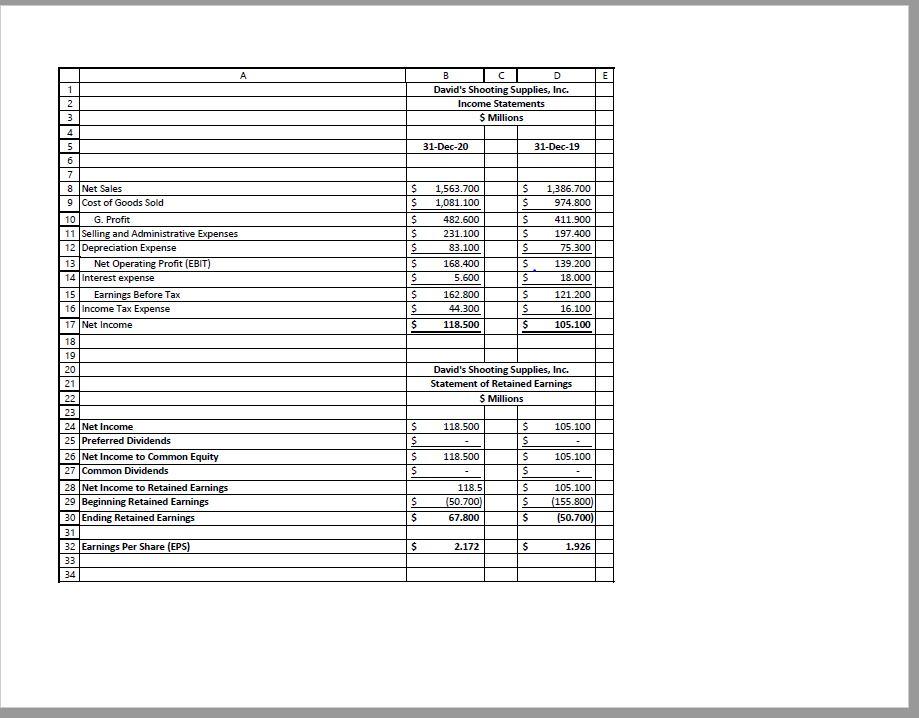

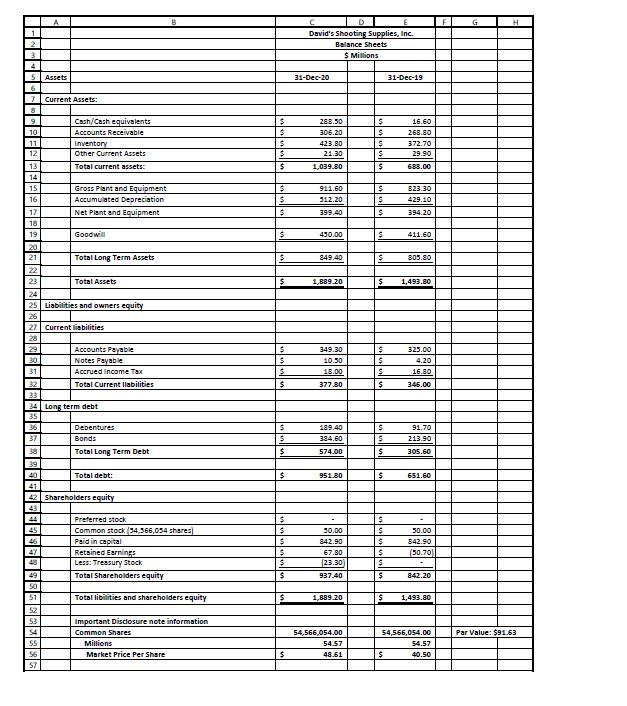

Question: 1. Using the financial statements and your spreadsheet, create the Vertical Statements for the years 2020 and 2019, and the Horizontal Statement for the year

1. Using the financial statements and your spreadsheet, create the Vertical Statements for the years 2020 and 2019, and the Horizontal Statement for the year 2020. 2. Using the financial statements and your spreadsheet, create the ratios covered in the course for the firm for both years 2019 and 2020.

A E 1 B D David's Shooting Supplies, Inc. Income Statements $ Millions 31-Dec-20 31-Dec-19 1,386.700 974.800 $ $ $ $ $ $ $ $ $ $ 1,563.700 1,081.100 482.600 231.100 83.100 168.400 5.600 162.800 44.300 118.500 $ $ $ S $ S $ $ $ $ 411.900 197.400 75.300 139.200 18.000 121.200 16.100 105.100 2 3 4 5 6 7 8 Net Sales 9 Cost of Goods Sold 10 G. Profit 11 Selling and Administrative Expenses 12 Depreciation Expense 13 Net Operating Profit (EBIT) 14 Interest expense 15 Earnings Before Tax 16 Income Tax Expense 17 Net Income 18 19 20 21 22 23 24 Net Income 25 Preferred Dividends 26 Net Income to Common Equity 27 Common Dividends 28 Net Income to Retained Earnings 29 Beginning Retained Earnings 30 Ending Retained Earnings 31 32 Earnings Per Share (EPS) 33 34 David's Shooting Supplies, Inc. Statement of Retained Earnings $ Millions 118.500 105.100 $ $ $ $ 118.500 105.100 $ $ $ $ $ $ $ $ $ 118.5 50.700) 67.800 105.100 (155.800) (50.700) $ 2.172 $ 1.926 A C H 1 David's Shooting Supplies, Inc. Balance Sheets $ Millions 3 31-Dec-20 31-Dec-19 $ $ $ $ $ 283.50 305.20 423.80 21.30 $ $ $ $ $ 16.60 268.80 372.70 29.90 688.00 1,039.80 $ $ $ 911.60 312.20 $ $ $ 323.30 429.10 394.20 399.40 S 430.00 $ 411.60 $ 849.40 $ 805.80 1,889.20 $ 1,493.80 5 Assets 6 7 Current Assets: 8 9 Cash/Cash equivalents 10 Accounts Receivable 11 Inventory 12 Other Current Assets 13 Total current assets 14 15 Gross Plant and Equipment 16 Accumulated Depreciation 17 Net Plant and Equipment 18 19 Goodwill 20 21 Total Long Term Assets 22 23 Total Assets 24 25 Liabilities and owners equity 26 27 Current liabilities 28 29 Accounts Payable 30 Notes Payable 31 Accrued Income Tax Total Current tinbilities 33 34 Long term debt 35 36 Debentures 37 Bonds 38 Total Long Term Debt 39 40 Total debt: 41 42 Shareholders equity 43 44 Preferred stock 45 Common stock 34 366,054 shares Paid in capital 47 Retained Earnings Less: Treasury Stock 49 Total Shareholders equity 50 51 Totallibilities and shareholders equity 52 53 important Disclosure note information 54 Common Shares SS ons 56 Market Price Per Share 57 $ $ 3 $ 349.30 10.50 13.00 377.80 $ $ $ $ 325.00 4.20 16.80 345.00 91.70 $ $ $ 189.40 384.60 574.00 $ $ 213.90 305.60 $ 951 80 $ 651.60 $ $ $ $ $ 30.00 842.90 67.30 123.30 $ $ $ $ $ $ 50.00 342.90 (50.70 937.40 842.20 $ 1,889.20 $ 1,493.80 Par Value: $91.63 54,566,054.00 54.57 48.61 54,566,054.00 54.57 $ 40.50 $ A E 1 B D David's Shooting Supplies, Inc. Income Statements $ Millions 31-Dec-20 31-Dec-19 1,386.700 974.800 $ $ $ $ $ $ $ $ $ $ 1,563.700 1,081.100 482.600 231.100 83.100 168.400 5.600 162.800 44.300 118.500 $ $ $ S $ S $ $ $ $ 411.900 197.400 75.300 139.200 18.000 121.200 16.100 105.100 2 3 4 5 6 7 8 Net Sales 9 Cost of Goods Sold 10 G. Profit 11 Selling and Administrative Expenses 12 Depreciation Expense 13 Net Operating Profit (EBIT) 14 Interest expense 15 Earnings Before Tax 16 Income Tax Expense 17 Net Income 18 19 20 21 22 23 24 Net Income 25 Preferred Dividends 26 Net Income to Common Equity 27 Common Dividends 28 Net Income to Retained Earnings 29 Beginning Retained Earnings 30 Ending Retained Earnings 31 32 Earnings Per Share (EPS) 33 34 David's Shooting Supplies, Inc. Statement of Retained Earnings $ Millions 118.500 105.100 $ $ $ $ 118.500 105.100 $ $ $ $ $ $ $ $ $ 118.5 50.700) 67.800 105.100 (155.800) (50.700) $ 2.172 $ 1.926 A C H 1 David's Shooting Supplies, Inc. Balance Sheets $ Millions 3 31-Dec-20 31-Dec-19 $ $ $ $ $ 283.50 305.20 423.80 21.30 $ $ $ $ $ 16.60 268.80 372.70 29.90 688.00 1,039.80 $ $ $ 911.60 312.20 $ $ $ 323.30 429.10 394.20 399.40 S 430.00 $ 411.60 $ 849.40 $ 805.80 1,889.20 $ 1,493.80 5 Assets 6 7 Current Assets: 8 9 Cash/Cash equivalents 10 Accounts Receivable 11 Inventory 12 Other Current Assets 13 Total current assets 14 15 Gross Plant and Equipment 16 Accumulated Depreciation 17 Net Plant and Equipment 18 19 Goodwill 20 21 Total Long Term Assets 22 23 Total Assets 24 25 Liabilities and owners equity 26 27 Current liabilities 28 29 Accounts Payable 30 Notes Payable 31 Accrued Income Tax Total Current tinbilities 33 34 Long term debt 35 36 Debentures 37 Bonds 38 Total Long Term Debt 39 40 Total debt: 41 42 Shareholders equity 43 44 Preferred stock 45 Common stock 34 366,054 shares Paid in capital 47 Retained Earnings Less: Treasury Stock 49 Total Shareholders equity 50 51 Totallibilities and shareholders equity 52 53 important Disclosure note information 54 Common Shares SS ons 56 Market Price Per Share 57 $ $ 3 $ 349.30 10.50 13.00 377.80 $ $ $ $ 325.00 4.20 16.80 345.00 91.70 $ $ $ 189.40 384.60 574.00 $ $ 213.90 305.60 $ 951 80 $ 651.60 $ $ $ $ $ 30.00 842.90 67.30 123.30 $ $ $ $ $ $ 50.00 342.90 (50.70 937.40 842.20 $ 1,889.20 $ 1,493.80 Par Value: $91.63 54,566,054.00 54.57 48.61 54,566,054.00 54.57 $ 40.50 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts