Question: 1. Using the information in the table, compute the structure of the optimal portfolio W when there are two risky assets, bond fund and

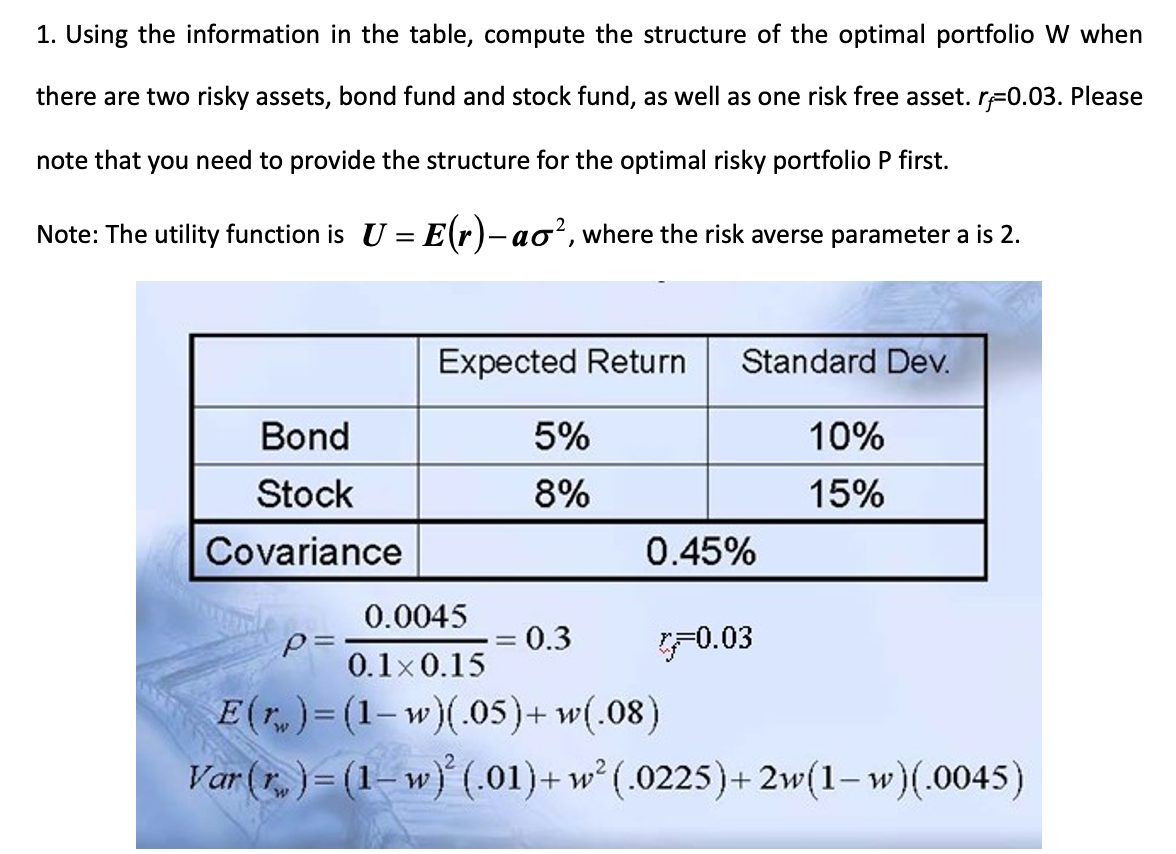

1. Using the information in the table, compute the structure of the optimal portfolio W when there are two risky assets, bond fund and stock fund, as well as one risk free asset. r=0.03. Please note that you need to provide the structure for the optimal risky portfolio P first. Note: The utility function is U = E(r) ao, where the risk averse parameter a is 2. Bond Stock Covariance Expected Return 0.0045 0.10.15 5% 8% = = 0.3 Standard Dev. 0.45% 10% 15% p= E()= (1-w)(.05)+w(.08) Var (r)=(1-w) (.01)+w (.0225)+2w(1-w)(.0045) -0.03

Step by Step Solution

There are 3 Steps involved in it

To find the structure of the optimal portfolio when there are two risky assets bond fund and stock f... View full answer

Get step-by-step solutions from verified subject matter experts