Question: 1. What is the average (annualized) raw return on your portfolio? 2. What is the average (annualized) Active return on your portfolio? 3. What is

1. What is the average (annualized) raw return on your portfolio?

2. What is the average (annualized) Active return on your portfolio?

3. What is the IR for your portfolio?

4. What is the Jensen's Alpha for your portfolio?

5. Using the data and metrics you calculated, in one short sentence (max 25 words) describe the performance of your portfolio.

6. For your optimized portolio: list the weights for stocks X1, X2, X3, X4, X5:

7. What parameters and constraints did you use for Solver?

8. Were there any special problems with the optimization?

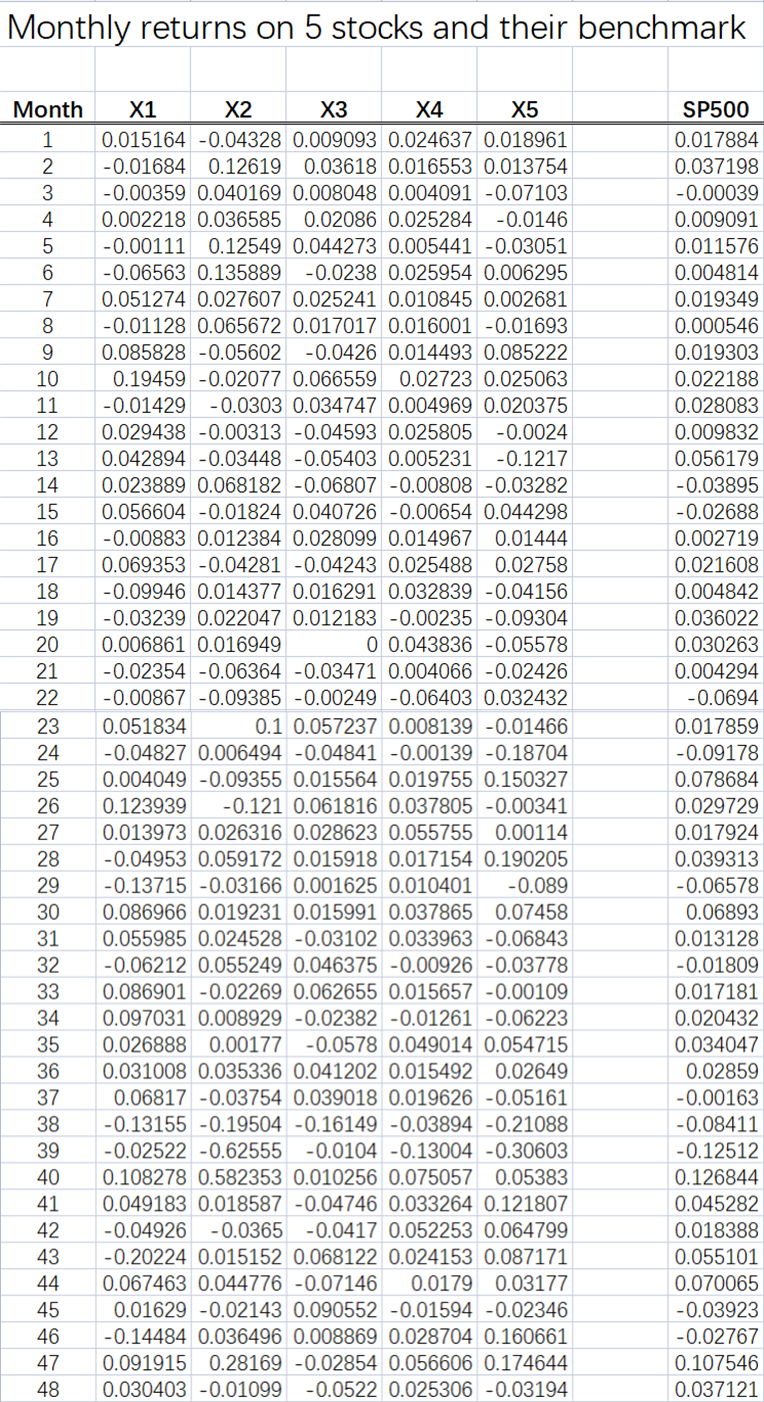

Monthly returns on 5 stocks and their benchmark Month 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 X1 X2 X3 X4 X5 0.015164 -0.04328 0.009093 0.024637 0.018961 -0.01684 0.12619 0.03618 0.016553 0.013754 -0.00359 0.040169 0.008048 0.004091 -0.07103 0.002218 0.036585 0.02086 0.025284 -0.0146 -0.00111 0.12549 0.044273 0.005441 -0.03051 -0.06563 0.135889 -0.0238 0.025954 0.006295 0.051274 0.027607 0.025241 0.010845 0.002681 -0.01128 0.065672 0.017017 0.016001 -0.01693 0.085828 -0.05602 -0.0426 0.014493 0.085222 0.19459 -0.02077 0.066559 0.02723 0.025063 -0.01429 -0.0303 0.034747 0.004969 0.020375 0.029438 -0.00313 -0.04593 0.025805 -0.0024 0.042894 -0.03448 -0.05403 0.005231 -0.1217 0.023889 0.068182 -0.06807 -0.00808 -0.03282 0.056604 -0.01824 0.040726 -0.00654 0.044298 -0.00883 0.012384 0.028099 0.014967 0.01444 0.069353 -0.04281 -0.04243 0.025488 0.02758 -0.09946 0.014377 0.016291 0.032839 -0.04156 -0.03239 0.022047 0.012183 -0.00235 -0.09304 0.006861 0.016949 0 0.043836 -0.05578 -0.02354 -0.06364 -0.03471 0.004066 -0.02426 -0.00867 -0.09385 -0.00249 -0.06403 0.032432 0.051834 0.1 0.057237 0.008139 -0.01466 -0.04827 0.006494 -0.04841 -0.00139 -0.18704 0.004049 -0.09355 0.015564 0.019755 0.150327 0.123939 -0.121 0.061816 0.037805 -0.00341 0.013973 0.026316 0.028623 0.055755 0.00114 -0.04953 0.059172 0.015918 0.017154 0.190205 -0.13715 -0.03166 0.001625 0.010401 -0.089 0.086966 0.019231 0.015991 0.037865 0.07458 0.055985 0.024528 -0.03102 0.033963 -0.06843 -0.06212 0.055249 0.046375 -0.00926 -0.03778 0.086901 -0.02269 0.062655 0.015657 -0.00109 0.097031 0.008929 -0.02382 -0.01261 -0.06223 0.026888 0.00177 -0.0578 0.049014 0.054715 0.031008 0.035336 0.041202 0.015492 0.02649 0.06817 -0.03754 0.039018 0.019626 -0.05161 -0.13155 -0.19504 -0.16149 -0.03894 -0.21088 -0.02522 -0.62555 -0.0104 -0.13004 -0.30603 0.108278 0.582353 0.010256 0.075057 0.05383 0.049183 0.018587 -0.04746 0.033264 0.121807 -0.04926 -0.0365 -0.0417 0.052253 0.064799 -0.20224 0.015152 0.068122 0.024153 0.087171 0.067463 0.044776 -0.07146 0.0179 0.03177 0.01629 -0.02143 0.090552 -0.01594 -0.02346 -0.14484 0.036496 0.008869 0.028704 0.160661 0.091915 0.28169 -0.02854 0.056606 0.174644 0.030403 -0.01099 -0.0522 0.025306 -0.03194 SP500 0.017884 0.037198 -0.00039 0.009091 0.011576 0.004814 0.019349 0.000546 0.019303 0.022188 0.028083 0.009832 0.056179 -0.03895 -0.02688 0.002719 0.021608 0.004842 0.036022 0.030263 0.004294 -0.0694 0.017859 -0.09178 0.078684 0.029729 0.017924 0.039313 -0.06578 0.06893 0.013128 -0.01809 0.017181 0.020432 0.034047 0.02859 -0.00163 -0.08411 -0.12512 0.126844 0.045282 0.018388 0.055101 0.070065 -0.03923 -0.02767 0.107546 0.037121 Monthly returns on 5 stocks and their benchmark Month 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 X1 X2 X3 X4 X5 0.015164 -0.04328 0.009093 0.024637 0.018961 -0.01684 0.12619 0.03618 0.016553 0.013754 -0.00359 0.040169 0.008048 0.004091 -0.07103 0.002218 0.036585 0.02086 0.025284 -0.0146 -0.00111 0.12549 0.044273 0.005441 -0.03051 -0.06563 0.135889 -0.0238 0.025954 0.006295 0.051274 0.027607 0.025241 0.010845 0.002681 -0.01128 0.065672 0.017017 0.016001 -0.01693 0.085828 -0.05602 -0.0426 0.014493 0.085222 0.19459 -0.02077 0.066559 0.02723 0.025063 -0.01429 -0.0303 0.034747 0.004969 0.020375 0.029438 -0.00313 -0.04593 0.025805 -0.0024 0.042894 -0.03448 -0.05403 0.005231 -0.1217 0.023889 0.068182 -0.06807 -0.00808 -0.03282 0.056604 -0.01824 0.040726 -0.00654 0.044298 -0.00883 0.012384 0.028099 0.014967 0.01444 0.069353 -0.04281 -0.04243 0.025488 0.02758 -0.09946 0.014377 0.016291 0.032839 -0.04156 -0.03239 0.022047 0.012183 -0.00235 -0.09304 0.006861 0.016949 0 0.043836 -0.05578 -0.02354 -0.06364 -0.03471 0.004066 -0.02426 -0.00867 -0.09385 -0.00249 -0.06403 0.032432 0.051834 0.1 0.057237 0.008139 -0.01466 -0.04827 0.006494 -0.04841 -0.00139 -0.18704 0.004049 -0.09355 0.015564 0.019755 0.150327 0.123939 -0.121 0.061816 0.037805 -0.00341 0.013973 0.026316 0.028623 0.055755 0.00114 -0.04953 0.059172 0.015918 0.017154 0.190205 -0.13715 -0.03166 0.001625 0.010401 -0.089 0.086966 0.019231 0.015991 0.037865 0.07458 0.055985 0.024528 -0.03102 0.033963 -0.06843 -0.06212 0.055249 0.046375 -0.00926 -0.03778 0.086901 -0.02269 0.062655 0.015657 -0.00109 0.097031 0.008929 -0.02382 -0.01261 -0.06223 0.026888 0.00177 -0.0578 0.049014 0.054715 0.031008 0.035336 0.041202 0.015492 0.02649 0.06817 -0.03754 0.039018 0.019626 -0.05161 -0.13155 -0.19504 -0.16149 -0.03894 -0.21088 -0.02522 -0.62555 -0.0104 -0.13004 -0.30603 0.108278 0.582353 0.010256 0.075057 0.05383 0.049183 0.018587 -0.04746 0.033264 0.121807 -0.04926 -0.0365 -0.0417 0.052253 0.064799 -0.20224 0.015152 0.068122 0.024153 0.087171 0.067463 0.044776 -0.07146 0.0179 0.03177 0.01629 -0.02143 0.090552 -0.01594 -0.02346 -0.14484 0.036496 0.008869 0.028704 0.160661 0.091915 0.28169 -0.02854 0.056606 0.174644 0.030403 -0.01099 -0.0522 0.025306 -0.03194 SP500 0.017884 0.037198 -0.00039 0.009091 0.011576 0.004814 0.019349 0.000546 0.019303 0.022188 0.028083 0.009832 0.056179 -0.03895 -0.02688 0.002719 0.021608 0.004842 0.036022 0.030263 0.004294 -0.0694 0.017859 -0.09178 0.078684 0.029729 0.017924 0.039313 -0.06578 0.06893 0.013128 -0.01809 0.017181 0.020432 0.034047 0.02859 -0.00163 -0.08411 -0.12512 0.126844 0.045282 0.018388 0.055101 0.070065 -0.03923 -0.02767 0.107546 0.037121

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts