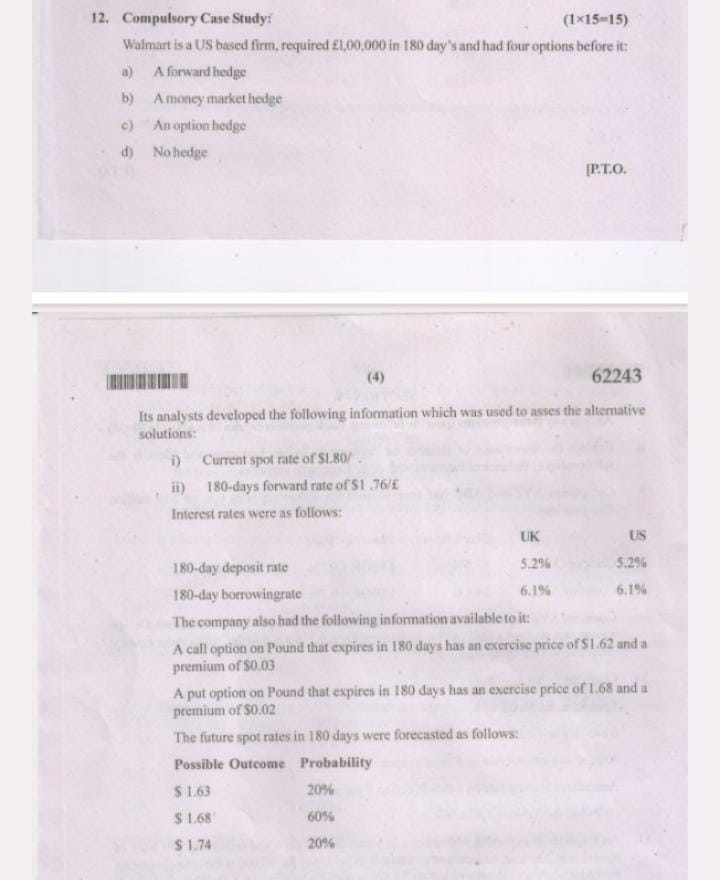

Question: 12. Compulsory Case Study: (1x15-15) Walmart is a US based firm, required 1,00,000 in 180 day's and had four options before it: A forward

12. Compulsory Case Study: (1x15-15) Walmart is a US based firm, required 1,00,000 in 180 day's and had four options before it: A forward hedge A money market hedge An option hedge No hedge a) b) c) d) 62243 Its analysts developed the following information which was used to asses the alternative solutions: i) Current spot rate of $1.80/ ii) 180-days forward rate of $1.76/E Interest rates were as follows: [P.T.O. UK 180-day deposit rate 5.2% 180-day borrowingrate 6.1% The company also had the following information available to it: A call option on Pound that expires in 180 days has an exercise price of $1.62 and a premium of $0.03 US 5.2% 6.1% 20% 60% 20% A put option on Pound that expires in 180 days has an exercise price of 1.68 and a premium of $0.02 The future spot rates in 180 days were forecasted as follows: Possible Outcome Probability $ 1.63 $ 1.68' $ 1.74

Step by Step Solution

There are 3 Steps involved in it

Here are the stepbystep calculations for each option a Forward hedge Walmart enters a forward contra... View full answer

Get step-by-step solutions from verified subject matter experts