Question: 123 Assignment 10: Problem 1 Previous Problem Problem List Next Problem (1 point) A 8-year bond with a face value of $5000 is redeemable at

123

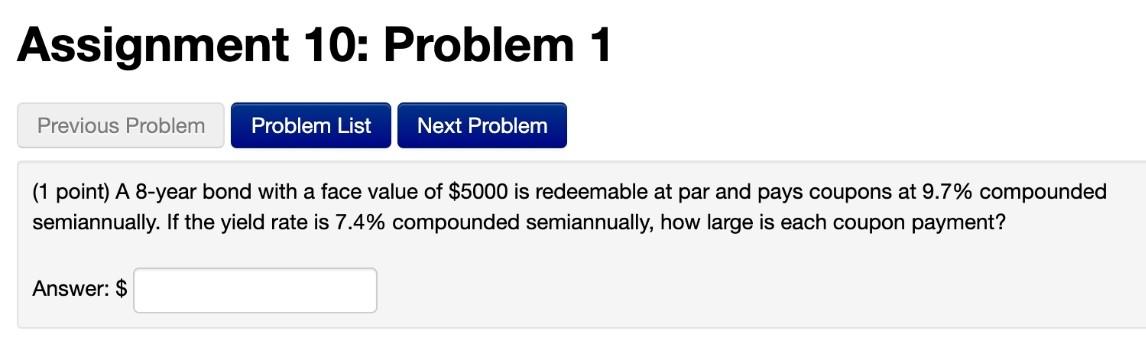

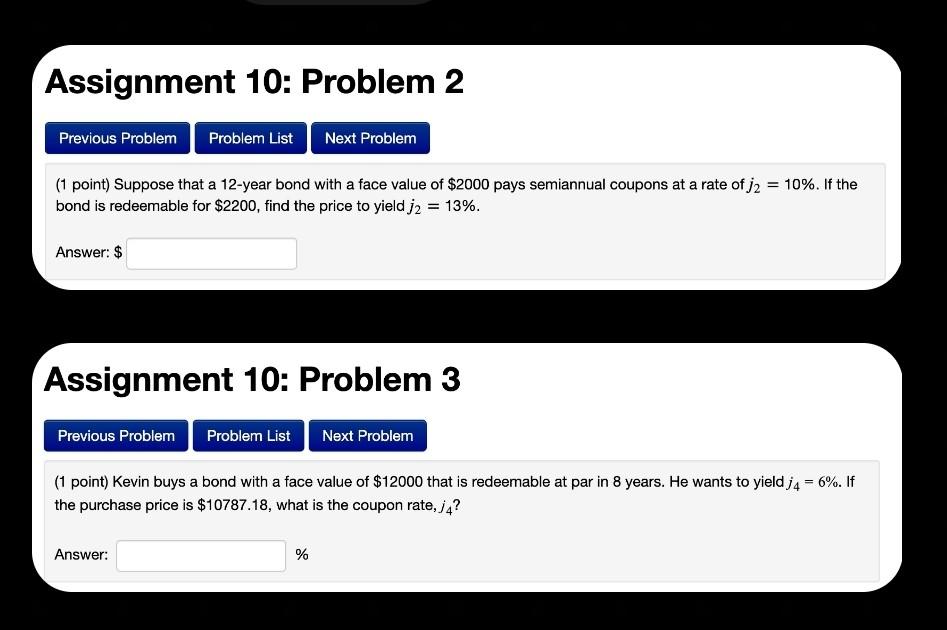

Assignment 10: Problem 1 Previous Problem Problem List Next Problem (1 point) A 8-year bond with a face value of $5000 is redeemable at par and pays coupons at 9.7% compounded semiannually. If the yield rate is 7.4% compounded semiannually, how large is each coupon payment? Answer: $ Assignment 10: Problem 2 Previous Problem Problem List Next Problem (1 point) Suppose that a 12-year bond with a face value of $2000 pays semiannual coupons at a rate of j2 = 10%. If the bond is redeemable for $2200, find the price to yield j2 = 13%. Answer: $ Assignment 10: Problem 3 Previous Problem Problem List Next Problem (1 point) Kevin buys a bond with a face value of $12000 that is redeemable at par in 8 years. He wants to yield j4 = 6%. If the purchase price is $10787.18, what is the coupon rate, j4? Answer: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts