Question: 13) The VaR (value at risk) measure is a function of: The time horizon and the loss level The time horizon and the confidence level

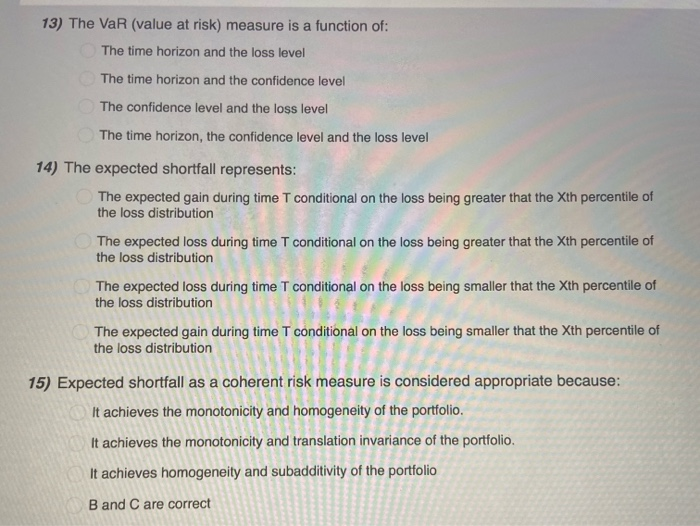

13) The VaR (value at risk) measure is a function of: The time horizon and the loss level The time horizon and the confidence level The confidence level and the loss level The time horizon, the confidence level and the loss level 14) The expected shortfall represents: The expected gain during time T conditional on the loss being greater that the Xth percentile of the loss distribution The expected loss during time T conditional on the loss being greater that the Xth percentile of the loss distribution The expected loss during time T conditional on the loss being smaller that the Xth percentile of the loss distribution The expected gain during time T conditional on the loss being smaller that the Xth percentile of the loss distribution 15) Expected shortfall as a coherent risk measure is considered appropriate because: It achieves the monotonicity and homogeneity of the portfolio. It achieves the monotonicity and translation invariance of the portfolio. It achieves homogeneity and subadditivity of the portfolio B and C are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts